What is Financial Portfolio Asset Allocation?

Financial Portfolio Asset Allocation is where you divide up your portfolio into segments. Selecting the segments depends on many factors which we will dive into below.

Boglehead investors keep investing simple where a typical asset allocation will have 3 to 7 funds including examples like “Boglehead 3 Fund Portfolio“, “Core Four Portfolio“, and others listed on our portfolio page.

You will hear these referenced as “Lazy Portfolios” however don’t let the term fool you as Lazy Portfolios have been proven to outperform actively managed portfolios 8 out of 10 years. You could keep your cake and eat it too.

Bogleheads use the Bogleheads Guide to Investing as the foundation for investing and building a portfolio asset allocation. earn about how Bogleheads use Asset Allocation to diversify and reduce risk in their investments.

Let’s dive into Financial Portfolio Asset Allocation

Portfolio allocation, also known as asset allocation, is the process of dividing an investor’s portfolio among different asset categories, such as stocks, bonds, and cash. The goal of portfolio allocation is to balance risk and reward based on the investor’s financial goals, risk tolerance, and investment horizon.

Asset Allocation Key Points

- Asset Classes: The three main asset classes are equities (stocks), fixed income (bonds), and cash and cash equivalents1. Each asset class has different levels of risk and return potential, and they will behave differently over time1.

- Risk Tolerance: This is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns2. A conservative investor, or one with a low-risk tolerance, tends to favor investments that will preserve their original investment2.

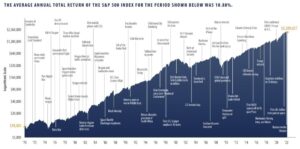

- Time Horizon: Your time horizon is the expected number of months, years, or decades you will be investing to achieve a particular financial goal2. An investor with a longer time horizon may feel more comfortable taking on a riskier, or more volatile, investment because they can wait out slow economic cycles and the inevitable ups and downs of the markets2.

- Age-Based Asset Allocation: Financial advisors generally recommend holding stocks for five years or longer. Cash and money market accounts are appropriate for goals less than a year away. Bonds fall somewhere in between1.

- Life-Cycle Funds: Some asset-allocation mutual funds are known as life-cycle or target-date funds. They set out to provide investors with portfolios that address their age, risk appetite, and investment goals with the correlated parts of different asset classes.

So then, what do you do?

We follow the Vanguard Boglehead investment philosophy. Read our detailed blog on the Bogleheads Guide to Investing Principles .

The Bogleheads investment philosophy promotes low-cost, do-it-yourself investing using nearly-free index funds and simple asset allocation formulas. Here are some examples of Bogleheads asset allocations:

- Bogleheads Four Funds Portfolio: This portfolio has an asset allocation of 80% Stocks and 20% Fixed Income.

- Bogleheads Three-fund Portfolio: This portfolio, popularized by Jack Bogle fans, uses only three fundamental asset classes: a U.S total stock market fund, a total international stock market fund, and a total bond market fund3. One example of this formula is 34% in US stocks, 33% in international stocks, and 33% in US bonds.

- Age-based Allocation: John Bogle, in his book Common Sense on Mutual Funds, recommends holding a percentage of bonds that corresponds to your age. For example, if you are 40, your portfolio should be 40% bonds.

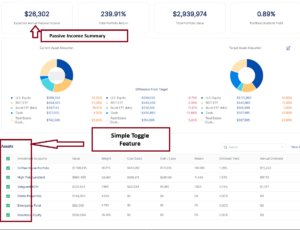

How AssetRise assists investors with Financial Portfolio Asset Allocation

AssetRise provides hundreds of pre-built Vanguard Portfolio template for Free. Use our free Online Portfolio Tool for up to 2 portfolios. Or, use our Premium Plan to create unlimited custom portfolios.

Remember, the best advice is to set a reasonable asset allocation for your risk tolerance, investing in low-fee broadly diversified funds. You can change it due to life events, but you should not change it because of market conditions.

A popular asset allocation approach will be to start wtih a simple portfolio, then as you learn over time you can introduce complexities. Use this as your “core savings” then create a seperate account to track individidual stocks or higher risk investments.

In Conclusion

In summary, asset allocation is a key concept in portfolio management, aiming to maximize returns by investing in different areas that would each react differently to the same event.

Try AssetRise at no cost, with no credit card required to join. Add your first 2 Vanguard Online Portfolios for free today.