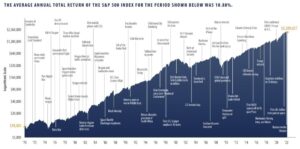

Bogleheads use the Bogleheads Guide to Investing as the investment principles including passive investing of ETF’s vs. actively managed portfolios. See below why the Vanguard S&P 500 Fund VOO outperforms higher cost mutual funds.

Vanguard S&P 500 ETF VOO

According to a study by S&P Dow Jones Indices, most investment advisers cannot beat the S&P 500. In fact, 60% of large-cap equity fund managers underperformed the S&P 500 in 2020 1. It was the 11th straight year the majority of fund managers lost to the market.

Therefore, trying to time the market is a losing proposition because it’s impossible to predict the future direction of the market with any degree of accuracy.

What does Active vs. Passive Investing mean?

An active investor is someone who buys stocks or other investments regularly. These investors search for and buy investments that are performing or that they believe will perform. Active investors believe they will outperform the S&P 500.

Bogleheads believe that active investing is a losing proposition as its impossible to predict the future markets. Thus Bogleheads follow passive investings. A passive investor rarely buys individual investments, preferring to hold an investment over a long period or purchase shares of a mutual or exchange-traded fund.

Warren Buffet’s Famous Bet

Warren Buffett has frequently argued that, for most people, a simple market-pegged portfolio is a smarter investment strategy than trying to pick winning stocks. This approach is similar to what the Vanguard Bogleheads investment philosophy is based on.

In January 2008, Buffett put this belief to the test: He bet a prominent hedge fund manager a million dollars that an S&P index fund would deliver better returns over 10 years than a fancy and expensive hedge fund portfolio consisting of actively selected stocks.

Buffett made this bet before the stock market collapsed during the financial crisis of that same year. But it didn’t matter — by 2015, the hedge fund manager had waved the white flag and admitted he’d lost.

Buffett’s index fund had made 7.1% per year; the hedge fund had made 2.2%. It wasn’t even close.

Bogleheads Do Not Time the Market

Instead, Bogleheads use a low cost, well diversified, set of Vanguard ETF funds such as:

- VTI: Vanguard Total Stock Market Index Fund ETF

- VXUS: Vanguard Total International Stock Index Fund ETF

- BND: Vanguard Total Bond Market Index Fund ETF

- VNQ: Vanguard Real Estate Index Fund ETF

- VOO: Vanguard 500 Index Fund ETF

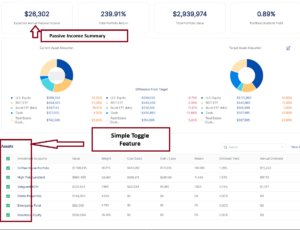

Boglehead and DIY Investors use the AssetRise Online Portfolio tools to build, track, and maintain a Boglehead well-diversified asset allocation approach.

What should individual investors do?

Bogleheads believe in creating a well-diversified ETF portfolio that is appropriate for their financial situation and goals.

ETFs are a popular choice for investors who want to:

- Diversification: Diversify their portfolios and gain exposure to a wide range of assets with minimal effort.

- Simplicity: cost-effective way to invest in the stock market.

- Benchmark: ETFs are designed to track the performance of a specific index, sector, commodity, or other assets.

- Highly Liquid: Unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a regular stock can.

- Low Expenses: ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually.

Try AssetRise at no cost, with no credit card required to join. Add your first 2 Vanguard Online Portfolios for free today.