Which is best? Dollar Cost Averaging or Lump Sum Invest?

There is no perfect ansswer whether an investor should “Lump Sum” invest new money or “Dollar Cost Average” over time into their portfolio.

In this blog we dive into the advantages and disadvantages of each option to help you determine which is best for you. Market Timing is another critical topic to understand as you invest new funds into your portfolio.

We recommend understanding the Bogleheads Guide to Investing along with the differences in ETF’s and Mutual Funds as keys to success in your investment journey.

New Money Investing Dilemma: Lump Sum vs. Dollar Cost Averaging

Investing in the stock market can be a daunting task, especially if you are new to it. There are different strategies that people follow to invest and make money. Two popular methods are lump sum investing and dollar-cost averaging. In this blog, we will discuss both approaches in detail, including their advantages and disadvantages, and real-life scenarios where they work best.

We will also analyze the risk factors involved in both methods and explain what market timing is and whether it works or not. Finally, we’ll provide some key takeaways and answer some frequently asked questions about market timing. By the end of this article, you will have a clear understanding of these investment strategies and be able to make an informed decision that aligns with your financial goals.

Understanding the Concept of Lump Sum Investing

Investors should assess their risk tolerance before opting for lump sum investing, which involves a large single investment for immediate market exposure. It can be advantageous in rising markets for potential long-term growth but requires careful financial consideration due to market volatility.

Advantages of Lump Sum Investing

Lump sum investing, aligned with a long-term strategy, may yield higher returns over time. It eliminates constant monitoring and may capitalize on market timing, especially during bear markets. This method suits investors expecting market growth despite short-term volatility, offering a hands-off approach to investment.

Disadvantages of Lump Sum Investing

Investing a large sum just before market downturns increases risk. Future market timing opportunities may be missed, causing psychological stress during volatility. Market tops could lead to suboptimal investment results, not aligning with some investors’ risk tolerance and diversification goals.

Diving Deep into Dollar Cost Averaging

Dollar cost averaging entails investing a fixed amount at regular intervals, aiming to lower the average share price through disciplined and consistent purchases. This method may help reduce the impact of market volatility on investment decisions, providing a risk-mitigating strategy for investing a large sum at an unfavorable time.

Benefits of Dollar Cost Averaging

Dollar cost averaging reduces the influence of market timing on investment decisions, providing independence from market fluctuations. It aligns with a long-term investment focus by spreading investment over time, potentially reducing stress during market downturns and supporting diversification across market highs and lows.

Limitations of Dollar Cost Averaging

Dollar cost averaging may lead to missed market timing opportunities, potentially resulting in suboptimal investment results during market rallies. Commitment to a long-term period is essential for full benefit, but there’s a potential opportunity cost associated with holding uninvested funds, making it unsuitable for quick investment gains.

Real-life Scenarios: Lump Sum vs. Dollar Cost Averaging

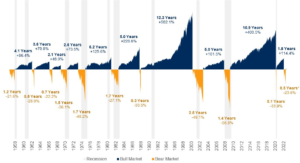

Assessing market trends’ impact on investment strategies, comparing results during uptrends and downtrends, and evaluating lump sum and dollar cost averaging effectiveness in varying conditions are crucial. Analyzing real-life scenarios uncovers how market timing influences investment outcomes. Understanding these dynamics is key to informed investing decisions.

Scenario 1: Market Uptrend

During market uptrends, evaluating the implications on lump sum investing is crucial. Assessing the investment results of dollar cost averaging in such conditions is equally important. Understanding how market timing affects investment strategies and analyzing the impact of market rallies using different methods can provide valuable insights. Identifying the pros and cons of both approaches in rising markets is essential.

Scenario 2: Market Downtrend

During a market downtrend, evaluating the impact on lump sum investing and assessing dollar cost averaging outcomes is crucial. Market timing significantly influences investment strategies, emphasizing the need to analyze market declines on investment returns. Identifying the advantages and limitations of both methods during falling markets is essential for informed decision-making.

Analyzing the Risk Factors in Both Methods

Evaluating the risks linked with lump sum investing amidst market volatility and assessing the necessary risk tolerance. Analyzing the risk management aspect of dollar cost averaging in varying market conditions and understanding the impact of risk diversification on investment strategies. Identifying the influential risk factors in decision-making between the two methods.

Risk Mitigation in Lump Sum Investing

Mitigating risk in lump sum investing requires careful assessment and diversification. Managing risk involves considering dividends, volatility, and adapting to market highs and downturns. Long-term strategies are essential for successful risk mitigation. Integrating these measures can help investors navigate the uncertainties of the stock market and achieve favorable outcomes.

Risk Mitigation in Dollar Cost Averaging

Dollar cost averaging reduces the impact of market volatility, crucial for risk management. Diversifying across assets and sectors is essential to mitigate risk. Considering dividends and volatility helps manage risk effectively. Adapting to market fluctuations and implementing a long-term investment strategy are key to mitigating risk in dollar cost averaging.

What Is Market Timing?

Market timing is a strategy where investors make decisions based on predicting future market movements. It involves buying and selling assets at opportune times to maximize returns. This approach relies on analyzing technical and fundamental indicators, but it carries high risk due to the challenge of accurately predicting market tops, bottoms, and reversals.

Market Timing: Will it Work?

Market timing strategies require careful consideration of market tops and bear markets. Independence day can affect market timing strategies. Consider trading hours and market holidays for market timing strategies. New York stock exchange hours are crucial for market timing strategies. Market timing involves risk tolerance assessment and investment strategies.

Market Timing in Lump Sum Investing

Market timing in lump sum investing is influenced by stock market hours, including the New York Stock Exchange and Tokyo Stock Exchange hours. Traders should assess liquidity, market highs, and market tops when considering market timing in lump sum investing. Downturns and bad news are interconnected with market timing in lump sum investing.

Market Timing in Dollar Cost Averaging

When implementing dollar cost averaging, market timing depends on stock market hours, including the New York Stock Exchange and Tokyo Stock Exchange. Traders should assess liquidity, market highs, and lows for effective timing. Market timing in dollar cost averaging is linked to downturns and bad news, impacting long-term results. Consider trading platforms and market opens for optimal market timing.

Criticism of Market Timing

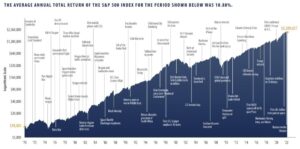

Attempting to predict stock market movements can result in missed opportunities and lower returns. Market timing strategies often underperform consistent investment approaches, requiring accurate predictions and substantial risk. Emotions and cognitive biases can further hinder effective market timing. Historical data showcases the rarity and unpredictability of successful market timing.

Is It Really Impossible to Time the Market?

Timing the market, a challenging endeavor, relies on predicting future movements. However, the inherent uncertainty and complexity of financial markets make successful market timing elusive. With volatility and speculation involved, accurate market timing is improbable despite the efforts of even experienced investors.

Here’s an example of where money managers lost 11 consecutive years to a simple Vanguard ETF Index.

Key Takeaways

Timing the stock market is fraught with risk, often leading to significant financial losses. Long-term, consistent investing typically outperforms market timing strategies, emphasizing the critical role of diversification and risk tolerance. Instead of market timing, focus on building a well-structured investment portfolio and consider dollar-cost averaging as a disciplined approach.

Is There a Middle Ground?

Combining different investment methods offers a balanced approach. Middle ground strategies consider market timing and long-term goals. By combining dollar cost averaging and lump sum investing, risks can be mitigated. Market liquidity and trading hours must be considered for these strategies. Diversification and identifying market tops are key in finding the middle ground.

Combining both methods

Combining both investment methods requires careful consideration of market timing and diversification. Factors such as Independence Day and Thanksgiving can impact the combination of these approaches. It’s essential to assess liquidity, dividends, and market timing, considering market holidays and trading platforms. Middle ground strategies involve evaluating risk tolerance and market tops.

Other investment strategies

When considering alternative investment strategies, it’s important to explore options like hedge funds and mutual funds. Market tops and global timing are crucial factors to evaluate. Emerging markets and long-term investment plans also play significant roles in diversifying your portfolio.

Making the Right Choice for Your Investment Needs

When making investment decisions, it’s crucial to assess risk tolerance and consider liquidity, market timing, and diversification. Market timing strategies play a significant role in choosing the right investment. Additionally, factors like Independence Day, Thanksgiving, and market hours in November and December can impact decision-making.

How Does Your Investment Choice Impact Your Financial Goals?

The impact of your investment choices on your financial goals is heavily influenced by market timing. To achieve your goals, it’s crucial to assess factors such as liquidity, dividends, and market tops and bear markets. Diversification and independence day also play a role in shaping the impact of your investment choices on your financial goals. Don’t forget that market timing strategies are essential for long-term success.

Market Timing FAQs

Attempting to time the stock market can lead to significant drawbacks, influenced by emotional decision-making. Empirical evidence does not support market timing, making long-term strategies a better choice. Diversification is crucial in mitigating market timing decisions, as it minimizes risks and optimizes portfolio performance.

Conclusion

In conclusion, the decision to invest a lump sum or use dollar cost averaging depends on various factors such as market conditions, risk tolerance, and financial goals. Lump sum investing offers the advantage of immediate market exposure and the potential for higher returns in a rising market. However, it also carries the risk of investing at the wrong time in a volatile market.

On the other hand, dollar cost averaging allows for a more gradual approach, reducing the impact of market fluctuations and potentially providing better risk management. It is important to consider your investment goals, time horizon, and risk tolerance before making a decision.

To stay updated on the latest investment strategies and market trends, subscribe to our newsletter for regular insights and analysis.

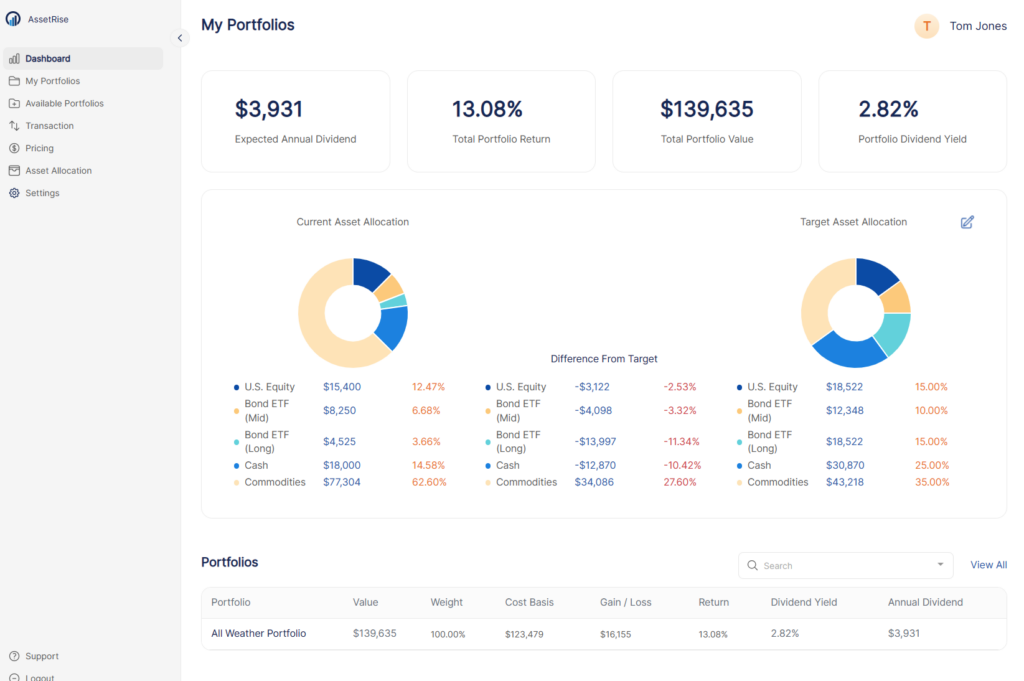

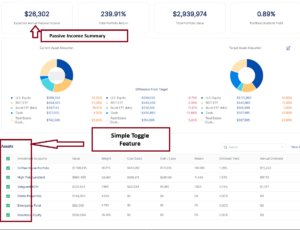

Try AssetRise at no cost, with no credit card required to join. Add your first 2 Vanguard Online Portfolios for free today.