Backtest Portfolio Asset Allocation

Portfolio backtesting is an essential tool for investors who want to make informed decisions about their asset allocation strategies. By analyzing historical returns and simulating different scenarios, investors can assess the viability of their portfolio allocation, understand risk characteristics, and evaluate investment performance. There are a number of online tools you can use for free including Portfolio Visualizor and Portfolio Metrics.

In this blog, we will explore the significance of portfolio backtesting, the steps involved in the process, and how it can help in effective asset allocation. So, let’s dive in and understand the fundamentals of backtesting portfolio asset allocation.

Understanding Portfolio Backtesting

Portfolio backtesting involves the analysis of historical returns of different asset classes within a portfolio. It helps in understanding the past performance of selected mutual funds, ETFs, and stocks.

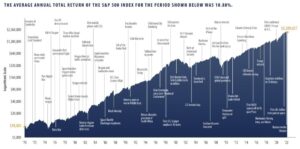

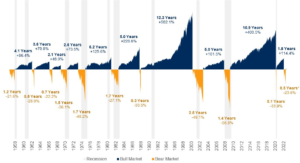

By using a backtesting tool, investors can simulate different time periods and historical market conditions to assess how their portfolio asset allocation would have performed in the past. This, in turn, provides insights into the potential future returns and risks associated with different allocation strategies.

Let’s now discuss the significance of portfolio backtesting in more detail.

Significance of Portfolio Backtesting

Portfolio backtesting holds immense significance in investment decision making. While historical returns do not guarantee future results, analyzing historical market data can provide valuable insights into the volatility and drawdowns of different portfolios. It helps in understanding the risk-return tradeoff for selected mutual funds, ETFs, and stocks.

Investors can also gain insights into the conditional value at risk of portfolios, which helps in assessing the downside risk of their investment strategies. Moreover, backtesting allows investors to analyze portfolio optimization and diversification benefits, aiding them in making informed asset allocation decisions.

Steps in Portfolio Backtesting

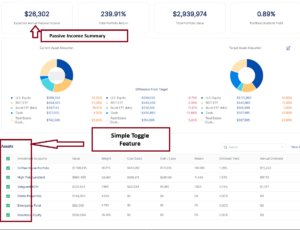

To backtest a portfolio asset allocation, investors follow a systematic approach. The first step involves selecting a backtesting tool that provides the necessary analytics and simulations such as Portfolio Metrics.

Once the tool is selected, investors can proceed to analyze different time periods and historical market conditions.

By simulating different allocation strategies, investors can assess the performance of their portfolios based on past market data. This step of simulation helps in gaining insights into potential future returns and risks associated with different asset allocation strategies. It also aids in the analysis of historical returns of different asset classes, which forms a crucial component of portfolio backtesting.

Diving into Portfolio Model Configuration

Once investors understand the importance of portfolio backtesting, the next step is to dive into portfolio model configuration. This involves selecting mutual funds, ETFs, and stocks, as well as setting up periodic contribution or withdrawal cashflows.

Let’s explore each of these aspects in detail.

Selecting Mutual Funds, ETFs, and Stocks

In portfolio backtesting, investors have the flexibility to select mutual funds, ETFs, and stocks that align with their investment goals. They can choose ticker symbols representing different asset classes and analyze the historical returns of selected mutual funds based on their historical performance.

By backtesting different combinations of mutual funds, investors can assess the performance of different allocation strategies and identify the ones that have historically outperformed the market. This analysis helps in making informed decisions regarding portfolio asset allocation and diversification.

Decoding Asset Allocation

Asset allocation is a crucial aspect of portfolio management. It involves diversifying investments across different asset classes to achieve optimal risk-adjusted returns. In this section, we will decode asset allocation and discuss its role in portfolio management.

Role of Asset Allocation in Portfolio Management

Asset allocation plays a vital role in portfolio management as it helps in achieving optimal risk-adjusted returns. By diversifying investments across different asset classes, such as stocks, bonds, and cash, investors can spread their risk and potentially mitigate losses. Strategic asset allocation involves considering various factors, including investment goals, risk tolerance, and time horizon, to create a well-balanced portfolio.

Effective asset allocation requires an analysis of asset class characteristics, historical returns, and correlations. It also involves periodic portfolio rebalancing to maintain the desired allocation and adjust for market changes.

Strategies for Effective Asset Allocation

To ensure effective asset allocation, investors can consider the following strategies:

- Utilize portfolio optimization techniques to identify the optimal asset allocation mix for a given risk tolerance and return objective.

- Analyze asset correlations to understand how different asset classes behave relative to each other.

- Implement a disciplined allocation strategy that considers factors such as risk tolerance, time horizon, and investment goals.

- Periodically review and rebalance portfolio allocations to maintain the desired asset class mix and risk profile.

You can read a deep analysis on Asset Allocation here.

Analyzing Portfolio Returns

Once portfolios are backtested and asset allocation strategies are implemented, investors need to analyze portfolio returns to evaluate performance. In this section, we will discuss two methods of analyzing portfolio returns: returns-based style analysis and holdings-based style analysis.

Evaluating Portfolio Style Exposure

Understanding portfolio style exposure is crucial for investors to assess the performance and characteristics of their portfolios. In this section, we will explore different methods of evaluating portfolio style exposure, including analyzing portfolio growth patterns and annual and rolling returns.

Portfolio Growth Patterns

Analyzing portfolio growth patterns helps investors understand the style exposure of different asset classes within their portfolio. By evaluating historical portfolio growth, investors can identify the contribution of different asset classes to overall returns.

This analysis provides insights into the potential risk and return characteristics of the portfolio. Additionally, analyzing compound annual growth rate (CAGR) helps investors assess the long-term performance of their portfolios and make informed decisions regarding asset allocation and investment strategy.

Annual and Rolling Returns

Evaluating annual and rolling returns is another method of assessing portfolio style exposure. By analyzing annual returns, investors can understand the performance of their portfolios over different time periods.

Rolling returns, which consider returns over rolling periods of a fixed length, provide insights into portfolio performance under changing market conditions. Monthly returns analysis helps investors gauge the consistency of returns and identify any patterns or trends. By evaluating annual and rolling returns, investors can make informed decisions about portfolio rebalancing, asset allocation, and investment strategy.

Decomposing Portfolio Performance

Decomposing portfolio performance allows investors to understand the drivers of returns and risks within their portfolios. In this section, we will explore two methods of decomposing portfolio performance: return decomposition and risk decomposition.

Portfolio Return Decomposition

Return decomposition involves analyzing portfolio returns to identify the contribution of different factors, such as asset class returns, dividends, and other sources of income. By understanding the drivers of returns, investors can determine the effectiveness of their investment strategies and adjust asset allocation accordingly. Dividends, in particular, play a crucial role in total return and, therefore, need to be considered when analyzing portfolio performance.

Portfolio Risk Decomposition

Risk decomposition, on the other hand, involves breaking down the risk of a portfolio into different components to understand the sources of risk. By analyzing risk metrics, such as standard deviation, beta, and value at risk (VaR), investors can assess the risk contribution of different asset classes within their portfolios.

This analysis helps in identifying diversification benefits, risk concentration, and potential areas of risk management improvement. By decomposing portfolio risk, investors can make informed decisions regarding asset allocation, risk management, and portfolio optimization.

How to Compare Different Portfolios?

Investors often need to compare different portfolios to evaluate their performance and make investment decisions. To effectively compare portfolios, investors can utilize backtesting tools that provide analytics, simulation, and benchmarking capabilities.

By comparing portfolio returns over different time periods, investors can assess the historical performance of different portfolios. They can also compare selected mutual funds’ metrics against benchmark returns for portfolio style analysis. Further analysis of fund fundamentals and historical returns aids in portfolio modeling and assists in selecting the preferred portfolio based on historical results.

Conclusion

In conclusion, portfolio backtesting is a crucial step in maximizing your investment returns and managing risks effectively. By understanding the significance of portfolio backtesting and following the steps outlined, you can make informed decisions about asset allocation and analyze portfolio returns.

Remember that successful investing requires continuous monitoring and adjustments based on market conditions. So, take advantage of portfolio backtesting to make informed investment decisions and achieve your financial objectives.

AssetRise recommends Portfolio Metrics for backtest analysis.