Boglehead 3-Fund Portfolio for Beginners

If you are a new or seasoned investor, the Boglehead 3 Fund Portfolio is arguably the most popular lazy portfolio option. This investment strategy, based on the philosophy of legendary investor John Bogle, emphasizes simplicity, diversification, and cost-effectiveness.

The Bogleheads 3 Fund Portfolio option is an excellent choice for building passive income and long term wealth.

In this blog, we will dive deep into the Boglehead 3 Fund Portfolio, exploring its key components, benefits, historical performance, risks associated with it, and how to implement it in 2024.

What is a Boglehead Investor?

“Bogleheads” are followers of the late Jack Bogle who abide to the following 10 investing principles. Learn more in our Bogleheads Guide to Investing post.

- Develop a workable investment plan.

- Invest early and often.

- Never bear too much or too little risk.

- Diversify.

- Don’t try to time the market.

- Use index funds whenever possible.

- Keep costs low.

- Minimize taxes.

- Invest with simplicity.

- Stay the course.

What is the Bogleheads 3 Fund Portfolio

The Boglehead 3 Fund Portfolio is a simple strategy based on the philosophy of Vanguard Group’s founder John Bogle.

It comprises of 3 primary investment categories: US total stock market, total international stock market, and total bond market index funds.

Popular Vanguard ETF funds used are:

- VTI: Vanguard Total Stock Market Index Fund

VXUS: Vanguard Total International Stock Index Fund

BND: Vanguard Total Bond Market Index Fund

The Philosophy Behind the Boglehead 3 Fund Portfolio

Grounded in simplicity, low cost, and broad diversification, the Boglehead 3 Fund Portfolio embodies the investment philosophy of John Bogle. It prioritizes long-term, low-turnover, and low-cost strategies to maximize returns while minimizing expenses and taxes.

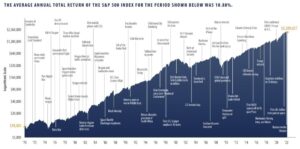

This approach reflects the belief that consistently beating the market is challenging due to market efficiency. Emphasizing time in the market over timing the market, the portfolio aligns with the principles of strategic partnership and sustainable growth.

Benefits of Using the Boglehead 3 Fund Portfolio

The Boglehead 3 Fund Portfolio presents a user-friendly, hands-off approach to passive investment income. It offers an inexpensive, diversified investment strategy suitable for both novice and seasoned investors. This portfolio streamlines the decision-making process, reducing the need for constant monitoring.

Simplicity and Ease of Management

The Boglehead 3 Fund Portfolio’s straightforward composition makes it easy for investors to comprehend and execute. With minimal ongoing management requirements, it reduces the time and effort for portfolio upkeep, appealing to individuals who prefer a hands-off investment strategy.

Diversification

A core tenet of the Boglehead 3 Fund Portfolio is its emphasis on broad diversification. This includes exposure to both domestic and international equities, as well as the bond market. Diversification plays a critical role in reducing overall portfolio risk by spreading investments across various asset classes and geographic regions.

Cost-effectiveness

The Boglehead 3 Fund Portfolio prioritizes cost-effectiveness by minimizing the impact of fees on investment returns. It focuses on low-cost, passively managed index funds with lower expense ratios, aiming to enhance long-term returns and preserve investor gains. This aligns with the Boglehead philosophy of reducing unnecessary costs and appeals to investors seeking a straightforward, low-cost solution with a focus on long-term value.

Comparing the Boglehead 3 Fund Portfolio vs. Managed Investments

Evaluating the Boglehead 3 Fund Portfolio against other investment strategies such as active management is an importnat factor. Bogleheads focus on passive investing bs. active invesing.

Passive Investing consists of minimal “hands on” management of investments vs. “active management” where portfolio managers attempt to outperform the S&P 500 through active buying and selling.

Boglehead 3 Fund Portfolio vs. Active Investing

When comparing the Boglehead 3 Fund Portfolio with active investing, it’s essential to highlight the differences in investment philosophy.

The Boglehead approach emphasizes passive, low-cost investing, while active investing involves ongoing management and higher fees. Investors can weigh the trade-offs between potential outperformance and cost efficiency in these two approaches, facilitating a well-informed selection of the most suitable investment strategy.

Step-by-Step Guide to Getting Started with the Boglehead 3 Fund Portfolio

A structured approach streamlines the initiation of the Boglehead 3 Fund Portfolio for novices.

Step 1: Understanding Your Financial Goals

Identifying and comprehending financial goals marks the initial and pivotal phase in the investment process. This step underscores the importance of aligning the Boglehead 3 Fund Portfolio with individual financial aspirations, emphasizing a strategic approach tailored to specific objectives.

Understanding personal financial goals is fundamental for crafting a customized and successful investment strategy, laying a sturdy foundation for a purposeful investment journey. Clear definition of financial goals forms the bedrock for a well-informed and effective investment strategy.

Step 2: Choosing the Right ETF’s

Selecting the most suitable ETFs is a crucial decision when creating the Boglehead 3 Fund Portfolio. This step emphasizes the significance of thorough research and careful consideration in choosing ETFs. We covered the common Vanguard ETF’s above: VTI, VXUS, and BND.

Step 3: Implementing the Portfolio

Effectively integrating the chosen ETFs into the investment portfolio is vital for successful execution. There are 2 primary methods to add funds to the Bogleheads 3 Fund Portfolio:

- Dollar Cost Averaging

- Lump Sum Investing

We dive into the pro and con of each method in a blog article.

Step 4: Periodic Review and Rebalancing

Regularly reviewing and rebalancing the portfolio is crucial for sustaining its optimal performance. This step underscores the importance of ongoing monitoring and adjustments in the investment journey. It emphasizes a proactive approach to ensure continued success and growth, contributing to the sustainability of the Boglehead 3 Fund Portfolio.

Adapting the Boglehead 3 Fund Portfolio to Your Personal Circumstances

Understanding the adaptability of the Boglehead 3 Fund Portfolio is crucial for tailoring it to individual circumstances. Your allocation % of VTI, VXUS, and BND is a key decision point we cover in detail in the Guide to Bogleheads Investing article.

Adapting for Age and Risk Tolerance

Adapting an investment portfolio based on age and risk tolerance is crucial for a well-suited strategy. It underscores the importance of aligning the portfolio with individual risk preferences and life stage.

Adapting for Financial Goals and Time Horizon

Align your investments with financial objectives, considering the time horizon for goal achievement. Adjust the portfolio according to risk tolerance and regularly realign it with changing goals. Monitor performance in relation to your time horizon.

Expert Tips for Maximizing Returns with the Boglehead 3 Fund Portfolio

- Utilize systematic creativity in dollar-cost averaging for optimal plant growth and reliable yields.

- Maintain discipline to avoid impulsive decisions amidst growing population and traffic jams.

- Focus on long-term strategy amidst local public transport developments and regional economic affairs.

- Periodically rebalance the portfolio to meet the terms of aesthetics and profitability of wind power projects.

Tip 1: Emphasizing Regular Investments

Emphasize regular contributions to the portfolio to capitalize on compounding benefits. Automate investments for convenience and consistency, prioritizing systematic planning for long-term wealth accumulation. Regularly monitor portfolio performance for informed adjustments.

Tip 2: Avoiding Emotional Investing Decisions

- Base your investment decisions on thorough research and analysis, steering clear of emotional influences. Refrain from impulsive reactions to short-term market fluctuations and instead, adopt a disciplined approach to investing that is independent of emotions.

- Prioritize understanding the rationale behind investment decisions before execution, minimizing the impact of emotional bias in the decision-making process.

Tip 3: Sticking to the Plan Despite Market Fluctuations

Maintain a steadfast commitment to the long-term investment strategy and resist the urge to deviate from the predetermined investment plan.

Acknowledge the inevitability of market fluctuations and remain resolute, staying focused on the overarching financial goals despite transient market movements. Review, reassess, and realign the investment plan, if necessary, without emotional interference. It’s essential to stay disciplined and avoid emotional investing decisions, ensuring that your investment strategy remains aligned with your long-term objectives.

Is the Boglehead 3 Fund Portfolio the Right Choice for You?

Considering your investment needs and goals, evaluating the alignment of the Boglehead 3 Fund Portfolio is crucial. Assess its diversification, risk management, and historical performance in different market conditions. Seek professional guidance to determine its appropriateness for your financial situation.

Assessing Your Investment Needs and Goals

To determine your investment needs, rank your short-term and long-term objectives. Align your risk tolerance with these goals and consider the time horizon for achieving them. Assess the compatibility of the Boglehead 3 Fund Portfolio with your unique needs, and seek professional advice to tailor the portfolio to your specific financial goals and time horizon.

Conclusion

In conclusion, the Boglehead 3 Fund Portfolio offers several benefits for beginners looking to invest in a simple and cost-effective manner. The portfolio’s emphasis on diversification, ease of management, and low costs make it an attractive option.

Additionally, historical performance suggests that the portfolio has delivered solid returns over time. However, it is important to consider the risks associated with market fluctuations, inflation, and rebalancing.

Comparisons with other investment strategies highlight the advantages of the Boglehead 3 Fund Portfolio.

To get started, assess your financial goals and choose the right ETFs. Regular review and periodic rebalancing are crucial for maintaining the portfolio’s effectiveness. By following expert tips and adapting the portfolio to your personal circumstances, you can maximize returns.

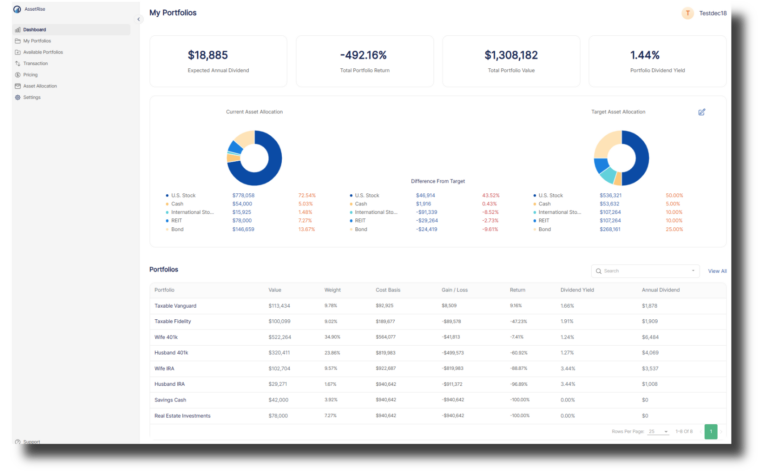

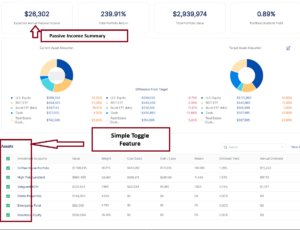

AssetRise is the preferred Portfolio Management Tool for Boglehead and Vanguard investors. See below for an image of our simple but powerful allocation dashboard.

Get started for free today