What is the Bogleheads Guide to Investing?

Welcome to The Bogleheads Guide to Investing. In this Blog we’ll cover the top 10 investing principles of Bogleheads. These principles are based on patience, discipline, and the power of compounding interest. They are designed to help investors achieve their financial goals over the long term.

Before you jump into buying stocks and bonds, invest time into your PLAN upfront. Now, let’s break down each of these principles including how I’ve applied them to my investing success.

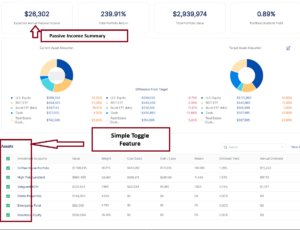

The AssetRise community is built upon the Bogleheads investment fundamentals below. AssetRise Portfolio Management is designed specifically to manage, track, and optimize Vanguard Boglehead portfolios.

Bogleheads Investing Principles

Workable Plan

A workable plan is a comprehensive financial plan that is tailored to your financial goals and risk tolerance. It should include a budget, an emergency fund, and a retirement plan. The plan should be reviewed and updated regularly to ensure that it remains relevant.

Each Boglehead develops a unique plan called an IPS. An Investment policy statement (IPS) is a statement that defines your general investment goals and objectives. It describes the strategies that you will use to meet these objectives, and contains specific information on subjects such as asset allocation, risk tolerance, and liquidity requirements.

The first step in investing as a Boglehead is to write down your IPS then stick to it. This will be critical as you navidate the highs and lows of investing.

Here is an IPS example for you to use

| Investment philosophy: | “Buy-and-hold, long-term, all-market-index strategies, implemented at rock-bottom cost, are the surest of all routes to the accumulation of wealth” – John C. Bogle |

|---|---|

| Asset allocation: | Maintain overall 60% stock + 40% fixed-income allocation until home purchase to accommodate both short-term and long-term requirements. Assets should be diversified across major asset classes including domestic equity, international equity (20-25% of equities), conventional bonds of short to intermediate term, and TIPS (50% of fixed). |

| Funds and accounts: | Use low cost mutual funds – index funds preferably – which do not overlap and provide maximum diversification across asset classes. Try to assume only market risk as far as possible. Try to shelter tax-inefficient funds in tax-advantaged accounts to reduce tax drag. |

| Target allocation: |

|

| Other considerations: | Automate future contributions wherever possible. Rebalance yearly. No market timing. Exact sub-allocations are not as important as maintaining the overall 60/40 stock/fixed allocation – no need to make things complex in order to meet sub-allocation targets. |

Too many investors fail since they have no plan. They simply jump into buying the latest stock or chase past performance. Nobody can predict the future, so build you plan and stick to it.

Invest Early and Often

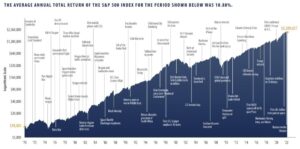

Once you have a regular savings pattern, you can begin accumulating financial wealth. How much saving is enough? For retirement, 20% of income may be a good starting point, but this will vary widely from person to person. If you want to be retire before age 65, or plan to leave significant assets to charity or to children, you probably need to save even more. Starting a regular savings plan early in life is important because investment returns compound over a longer period.

The image below demonstrates the benefit of starting early.

The best way to save money is to arrange automatic deductions from your paycheck. Many 401(k)s offer this. When you invest in an IRA or taxable account, choose a provider that will automatically deduct money from your bank account the day after pay day. This is described as “paying yourself first,” and it goes a long way towards establishing and reinforcing reasonable spending habits.

There are guidelines for which accounts you should fund and in what order. But always remember, you first need to save the money. When you start, saving regularly is more important than your choice of investments.

Bearing Risk

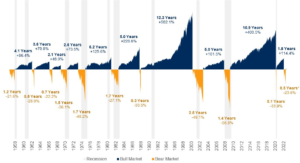

Your risk tolerance is your ability to stick to an investment plan through difficult financial and market conditions. To know if an asset allocation matches your risk tolerance, ask yourself if you held it, would you sell during the next bear market? This is very hard to answer honestly before you have experienced one.

In Bogleheads investing philosophy, it’s important to invest in a way that is appropriate for your financial situation and goals . This means that you should never bear too much or too little risk. Investing too conservatively can result in lower returns, while investing too aggressively can lead to higher risk and potential losses.

To determine the appropriate level of risk for your investments, you should consider your financial goals, time horizon, and risk tolerance. If you’re investing for a long-term goal, such as retirement, you may be able to tolerate more risk than if you’re investing for a short-term goal, such as a down payment on a house. It’s important to find a balance between risk and reward that is appropriate for your individual situation.

To give you enough money for retirement, you want assets with a decent expected return. This means you need to own stocks. Stocks return a share of the profits generated by publicly owned companies. But although they offer a chance of good returns, stocks are volatile and risky. In 2008, some markets fell 50% from their previous highs. Over time, stock prices roughly follow the trend of the economy, which is to grow. But prices can stagnate or decline for decade-long periods. This is why your asset allocation needs to include bonds as well as stocks. Boglehead philosophy is to buy stocks in a well diversified, low cost Index Fund.

The most popular stock fund is the Vanduard VTI ETF: Vanguard Total Stock Market Index Fund ETF consisting of over 3,000 U.S. stocks.

Bonds are a promise to pay back a loan of money on a set schedule. Bonds do not have the expected returns of stocks, but they are much less volatile. A mix of stocks and bonds will produce reasonable growth while limiting the size of the inevitable drops. How much in bonds? This is the basic question of asset allocation. Before you decide, you first need to balance your ability, willingness, and need to take risk. The more risk you can handle, the less bonds you need. When you are young, your prime earning years lie ahead, and it will be decades before you need to access the money. So, higher stock allocations may be suitable, because big drops in stock prices will not hurt as long as you do not sell during the drop.

John Bogle wrote:[2]

[A]s we age, we usually have (1) more wealth to protect, (2) less time to recoup severe losses, (3) greater need for income, and (4) perhaps an increased nervousness as markets jump around. All four of these factors suggest more bonds as we age.

— Common Sense on Mutual Funds, John Bogle

Although your exact asset allocation should depend on your goals for the money, there are a few general guidelines that you can follow. These are based on practice rather than on theory, and are only a starting point for decision making, not the end.

Although your exact asset allocation should depend on your goals for the money, there are a few general guidelines that you can follow. These are based on practice rather than on theory, and are only a starting point for decision making, not the end.

For example, Benjamin Graham wrote:[3]

We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequence inverse range of 75% to 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums.

— Quoted in The Intelligent Investor, Jason Zweig

Alternatively, John Bogle recommends “roughly your age in bonds“. For instance, if you are 45, 45% of your portfolio should be in high-quality bonds. He describes the idea as just “a crude starting point” which “[c]learly … must be adjusted to reflect an investor’s objectives, risk tolerance, and overall financial position“. He also suggests that you should treat any national or state retirement income you might receive as if it is a bond, setting its assumed value appropriately.

This “age in bonds” and its variants, age minus ten years or age minus twenty years, are only approximate starting points. You will probably want to adjust them to fit your circumstances. For example, if you have a guaranteed state or other pension, this changes both your need and your willingness to take risk. Some investors do not add pensions and Social Security to their asset allocation of bond holdings.

It is easy to underestimate risk and to overestimate your tolerance for risk. In 2008, many people learned too late that they should have been holding more bonds. Think carefully before choosing an asset allocation with high stock market allocations. If you have not been through a major market downturn before, your abstract logical thoughts about risk can quickly become emotional ones. The developing field of neuroeconomics explains how mental traits and emotional effects that work well in other areas undermine our ability to deal rationally with markets and investing.

You should generally own bond funds instead of individual bonds, for convenience and diversification. Using individual corporate or municipal bonds require a very large holding in order to achieve the broad diversification and increased safety of a bond fund. The high number of different bonds in bond funds lets you ignore the risk of any one bond defaulting. You can manage Interest rate risk by choosing funds with short and intermediate-term duration, and default risk by choosing funds with high credit ratings. The idea here is for your bond holdings to reduce violent up and down swings in overall portfolio value. You want your risks on the equity side, not the bond side.

The most popular Bogleheads bond fund is the ETF BND: Vanguard Total Bond Market for its low cost and diversification.

Never Try to Time the Market

According to the Bogleheads investing philosophy, it’s important to avoid trying to time the market. This means that investors should not attempt to predict the market’s ups and downs and make investment decisions based on those predictions. Instead, investors should focus on creating a well-diversified portfolio that is appropriate for their financial situation and goals.

The Bogleheads believe that trying to time the market is a losing proposition because it’s impossible to predict the future direction of the market with any degree of accuracy. Instead, investors should focus on the long-term and remain disciplined in their approach. By investing regularly and staying the course, investors can achieve their financial goals over the long term.

Check out this article: Vanguard S&P 500 ETF VOO outperforms actively managed funds 11 consecutive years.

Use Index Funds When Possible

According to the Bogleheads investing philosophy, it’s recommended to use index funds when possible. Why use Indx Funds vs. Individual Stocks? Index funds are low-cost and provide broad market exposure. They are designed to track the performance of a specific market index, such as the S&P 500, and are passively managed. This means that they have lower fees than actively managed funds, which can help to keep investment costs low.

The Bogleheads believe that using index funds is a simple and effective way to build a diversified portfolio that is appropriate for your financial situation and goals. By investing in index funds, you can gain exposure to a wide range of stocks or bonds with minimal effort. This can help to reduce risk and increase returns over the long term.

The 5 most common Index Funds used by Bogleheads are:

- VTI: Vanguard Total Stock Market Index Fund ETF

- VXUS: Vanguard Total International Stock Index Fund ETF

- BND: Vanguard Total Bond Market Index Fund ETF

- VNQ: Vanguard Real Estate Index Fund ETF

- VOO: Vanguard 500 Index Fund ETF

Learn more about how to structure your portfolio by using an Investment Portfolio Asset Allocation strategy.

Keep Costs Low

According to the Bogleheads investing philosophy, it’s important to keep costs low when investing . This means that investors should avoid high-fee funds and unnecessary trading. By minimizing investment costs, investors can keep more of their returns and achieve their financial goals over the long term.

The Bogleheads believe that using low-cost index funds is an effective way to keep investment costs low . Index funds are passively managed and have lower fees than actively managed funds. This can help to reduce investment costs and increase returns over the long term.

Diversify

According to the Bogleheads investing philosophy, diversification is a crucial component of a successful investment strategy. The Bogleheads recommend spreading your investments across different asset classes to reduce risk. This means investing in a variety of stocks, bonds, and other securities.

The Bogleheads believe that diversification can help to reduce risk and increase returns over the long term. By investing in a variety of asset classes, you can reduce the impact of any one investment on your overall portfolio. This can help to minimize the impact of market volatility and reduce the risk of significant losses.

Minimize Taxes

According to the Bogleheads investing philosophy, minimizing taxes is an important aspect of a successful investment strategy. Here are some ways to minimize investment-related taxes:

- Maximize contributions to tax-sheltered accounts: Contributing to tax-sheltered accounts such as 401(k)s, IRAs, and HSAs can help to reduce your taxable income and lower your tax bill.

- Invest tax-efficiently within taxable accounts: By investing in tax-efficient funds and holding them for the long term, you can minimize the amount of taxes you owe on your investments.

- Pay attention to “asset location”: By placing tax-inefficient assets such as bonds in tax-sheltered accounts and tax-efficient assets such as stocks in taxable accounts, you can further reduce your tax bill.

- “Back Door Roth”: Use Traditional IRA to fund the Roth IRA one time per account annually.

Invest with Simplicity

The Bogleheads believe that keeping your investment strategy simple and easy to understand can help you stay disciplined and avoid making impulsive decisions based on short-term market movements.

One way to invest with simplicity is to create a three-fund portfolio that includes a total stock market index fund such as VTI, a total international stock index fund such as VXUS, and a total bond market fund such as BND. This approach is designed to provide broad market exposure while keeping investment costs low.

By investing with simplicity, you can avoid the complexity and confusion that can come with more complicated investment strategies. This can help you stay focused on your long-term financial goals and achieve success over the long term.

For seasoned investors this level of simplicity will seem counterintuitive. However the data shows that a simple portfolio of low cost ETF Indes will outperform a stock pickers portfolio over the long term.

And…Stay the Course!

Look, investing is a very empotional game as you are playing with your hard earned savings. Bogleheads believe that its critical that investors should stick to their investment plan and avoid making impulsive decisions based on short-term market movements.

The Bogleheads believe that staying the course is important because it helps investors avoid the temptation to buy and sell based on emotions rather than logic. By remaining disciplined and focused on their long-term financial goals, investors can achieve success over the long term.

Wrapping it Up

I’ve been a Boglehead investor for over 10 years, by following these principles I have grown significant wealth over time. I’m very fortunate to have discovered the Boglehead investing principles at a young age after trying 2 failed investment advisors.

While you don’t need to put 100% of your investments into a Bogleheads portfolio, I hope you consider adding your “core” investments into it. You will be thankful over time.