Embracing Regression to the Mean – Bogleheads

Introduction

In the world of investing, there are many strategies and concepts that can help guide investors in making informed decisions. One such concept is regression to the mean, or mean reversion.

This theory suggests that over the long run, stock prices tend to move back towards their historical averages. Understanding and embracing regression to the mean can be a powerful tool for investors, as it helps to identify potential price corrections and assists in formulating effective investment strategies.

Understanding the Concept of Mean Reversion

Understanding the Concept of Mean Reversion

Before delving into the specifics of mean reversion, it is important to have a clear understanding of the term itself. Regression to the mean, also known as mean reversion, is the concept that suggests that extreme events or outliers will eventually move towards the average or mean over time.

In the context of the stock market, it refers to the idea that stocks that have experienced significant price changes, either upward or downward, are likely to revert to their historical averages in the long run. This phenomenon is based on the belief that stock prices tend to move in cycles, experiencing periods of overvaluation and undervaluation.

Defining Mean Reversion in the Stock Market

Defining Mean Reversion in the Stock Market

Mean reversion in the stock market involves identifying periods when stock prices deviate significantly from their historical averages. This can be achieved through the use of various technical indicators, statistical analysis, and chart patterns. By recognizing these deviations, investors can anticipate potential price corrections in the market and make more informed investment decisions.

The concept of mean reversion in the stock market is grounded in the belief that stock prices are influenced by various factors, including market sentiment, investor behavior, and economic conditions. As a result, stock prices often fluctuate, deviating from their long-term averages. Mean reversion seeks to capitalize on these deviations, as it assumes that stock prices will eventually move back towards their historical mean.

Investors utilize mean reversion as a tool to predict market changes based on historical data. By identifying periods of overvaluation or undervaluation, investors can make decisions about buying or selling stocks. If a stock has experienced a significant price increase and is considered to be overvalued, mean reversion suggests that it is likely to regress to its historical mean. Conversely, if a stock has experienced a significant price decrease and is deemed undervalued, mean reversion suggests that it is likely to move back towards its historical average in the long run.

Mean reversion can be particularly valuable for long-term investors who are looking to build and manage their portfolios over extended periods. By incorporating mean reversion into their investment strategies, these investors can potentially take advantage of stock price fluctuations and make more informed decisions about when to buy or sell.

Historical Evidence of Mean Reversion

Historical Evidence of Mean Reversion

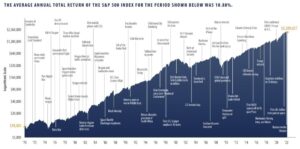

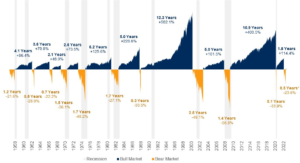

The theory of mean reversion in the stock market is supported by ample historical evidence. Over the years, numerous studies have demonstrated the cyclical nature of stock prices, providing validation for the concept of regression to the mean.

Here are some key points of historical evidence:

- Historical data consistently shows that stocks that have performed exceptionally tend to regress to the mean. This means that stocks that have experienced significant price increases are likely to experience a period of underperformance, while stocks that have experienced significant price decreases are likely to bounce back.

- Statistical analysis has revealed consistent patterns of mean reversion in various markets and sectors. These findings support the belief that stock prices tend to move in cycles, with periods of overvaluation followed by periods of undervaluation.

- Long-term studies conducted by renowned investors, such as Jack Bogle, founder of Vanguard, and Jeremy Siegel, professor of finance at the Wharton School, have provided empirical evidence for mean reversion in the stock market. These studies suggest that over the long run, stock prices have a tendency to move back towards their long-term averages.

- Observations of stock market bubbles and crashes also support the concept of mean reversion. During periods of excessive optimism or pessimism, stock prices can deviate significantly from their long-term averages. However, in most cases, these extreme price movements are followed by a correction, as stock prices revert back to their historical averages.

- A study conducted by the National Bureau of Economic Research found that mean reversion is more prevalent in small-cap stocks compared to large-cap stocks. This suggests that smaller companies, which may be subject to greater price volatility, are more likely to experience significant deviations from their long-term averages.

- Overall, historical evidence consistently reinforces the theory of mean reversion in the stock market. It highlights the importance of identifying periods of overvaluation and undervaluation in order to make informed investment decisions. By embracing regression to the mean, investors can better navigate the ups and downs of the market and potentially enhance their long-term returns.

The Role of Mean Reversion in Investment Strategies

The Role of Mean Reversion in Investment Strategies

Mean reversion plays a crucial role in formulating effective investment strategies. Investors, including notable figures like Jack Bogle, often utilize mean reversion to identify opportunities in the market. By identifying stocks that have deviated significantly from their long-term averages, investors can potentially identify undervalued or overvalued stocks. This approach helps investors diversify their portfolios and seek potential opportunities for greater returns.

Closing Thoughts on Mean Reversion

Embracing the principles of mean reversion can assist investors in making more informed choices when it comes to their investments. Understanding this concept serves as a valuable reminder of the market’s cyclical patterns, prompting investors to consider the broader picture. By integrating mean reversion into their investment evaluations, individuals can potentially build more resilient and diversified portfolios that are better equipped to withstand market fluctuations in the long run.

Is Mean Reversion a Reliable Phenomenon in the Long Term?

Exploring the reliability of mean reversion over extended periods reveals its significance in guiding long-term investment decisions. Historical data supports using mean reversion as a valuable tool for investors to enhance their long-term investment strategies.

Conclusion

In conclusion, embracing the concept of regression to the mean, especially in the context of mean reversion in the stock market, can provide valuable insights for investment strategies. Historical evidence suggests the presence of mean reversion, highlighting its significance in long-term investment decisions.

Understanding this phenomenon can aid investors in making informed choices and mitigating risks associated with market fluctuations. By acknowledging the role of mean reversion, investors can adopt more rational and disciplined approaches to portfolio management, aligning their investment strategies with the principles of statistical regression.

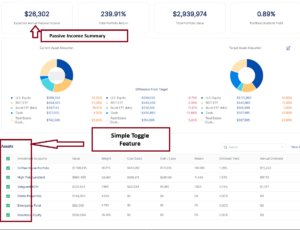

At AssetRise we believe in the Vanguard Bogleheads principles of Index Investing.

The AssetRise tool provides portfolio rebalancing, dividend projections, and portfolio return for all your investment accounts in a single dashboard. Add 2 accounts for free.

Add your first 2 portfolios for FREE. AssetRise provides the industry leading portfolio rebalance calculator.

Disclaimer: the information in this article is for information and research purposes only. It does constitute financial advice.