How to start investing as a Boglehead

Now that you understand “What is a Boglehead” and “Boglehead Investing Principles“, this post is to help you understand the 4 steps to get started as a new Boglehead investor.

Step 1: Select Your Asset Allocation

We covered Asset Allocation in detail in this blog so we suggest reading that first. Now that you have an understanding of Asset Allocation as a Boglehead, your actions will depend on where you are on your investment journey:

New Investor

If you’re a new investor its much simpler than an investor who needs to “transition” from a complex portfolio to a simple Boglehead portfolio. A new investor needs to select their asset allocation % then align the Vanguard ETF’s to the allocation.

We provide a number of pre-selected portfolios at AssetRise for you to pick from. You can select a pre-built portfolio or build from scratch within our portfolio tool.

It will feel overwhelming at first, to pick the “perfect” portfolio allocation out of thousands of possibilities. Its best to start simple, gain experience, then you can always adjust over time. That’s why many investors will start with the Boglehead 3 Fund Portfolio.

Experienced & Current Investor

Starting as a Boglehead can be a bit tricky for an existing investor as most of the time you are moving from a complex portfolio mix of individual stocks, bongs, mutual funds across many accounts. You also need to take into consideration of tax consequences of selling non-sheltered assets such as a taxable account.

Most of us will do a “wholesale” sell of our assets to cash, then begin buying the Boglehead assets to fill up our portfolio. It would be best to consult with your CPA or sel-research to understand the tax consequnces of any asset sales.

Step 2: Input & Track Your Assets

Now that you have a clear asset allocation aligned to the Vanguard ETF’s for your portfolio, life will become much simpler! You will move from a very complex investplan plan to ultra-simple.

One of the considerations you will have is to track and manage your asset allocation and rebalance. The good news is your strategy is simple – keep track of your asset allocation then rebalance so you sell high and buy low.

You will have a few options of how to manage your Boglehead Vanguard Portfolio:

Spreadsheets

Most investors will jump to Google Sheets or Excel to manually build out their portfolio tracking. We list some examples here to use.

The pro is its free and you can customize. The downside is how do you keep current as market prices change daily, what cycle do you update, and what happens when you have multiple accounts to overlay asset allocation. For example, how do you track your asset allocation across a taxable, IRA, and 401k account? The spreadsheet begins to grow in complexity.

Many people simply don’t want to spend time updating and keeping spreadsheets current.

Institutional Dashboards (Fidelity, Vanguard, Schwab)

Your investment holder will provide dashboards to see and track your invesments, including some tools to assist with planning. Fidelity and Vanguard provide tools to assist you in investment analysis. What these dashboards are missing is a wholistic view of all your investments across all accounts. For example: if you have a taxable account at E-Trade and your 401k at Fidelity, along with an IRA at Vanguard then how do you get a wholistic asset allocation across all accounts? While Fidelity has begun to add plug ins to bring assets from other providers, its lacking the views that a Boglehead will need to see to rebalance.

The reason quite frankly is Fidelity, E-Trade, and others are focused on you buying more assets from them not asset allocation outside of their accounts with you.

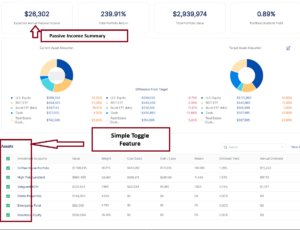

AssetRise Online Portfolio Tool

AssetRise was designed from day 1 to align to Boglehead investment principles of a low cost, simple asset allocation that is easy to rebalance. AssetRise features tracking, optimization, and rebalancing exactly how a Boglehead would invest.

AssetRise does not hold investments, but a management tool to track your allocation, report to you weekly, monitor from “drift”, and assist you with the data you need to take action.

AssetRise provides the flexibily to track your investments across investment firms, including the asset type, tickers updated real-time, and even custom assets to your liking.

The result is a simple asset allocation that a Boglehead needs to stay current without the need for manual tracking or spreadsheets.

Step 3: Monitor Your Assets

Now that your portfolio is in place, it becomes critical to monitor your portolio! Too many investors lose motivation becuase after they have their portfolio in place, they don’t know what to do next.

You need a tool or program to monitor and optimize your assets. Whether you are manually using spreadsheets or a tool like AssetRise you need to take action to ensure your investment success.

Step 4: Identify Rebalance Opportunities

We cover rebalance strategies in this blog post. You can also find details on the Bogleheads site.

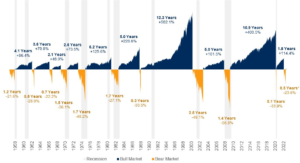

The basic: you select an asset class, let’s say 50% stocks and 50% bonds. As markets change, your allocation will also change. So you will need to “rebalance” to keep your portfolio in aligned to 50/50.

Remember you can rebalance with “new money”. In other words if you are low in an asset class, then you can add new money via dollar cost averaging to bring that allocation up to the target. In essence you should be “buying low” if that asset class is down.

Aside from your rebalancing strategy, you need to have a clear picture of your asset allocation at all times to make informed decisions. This is how you optimize your returns as an investor.

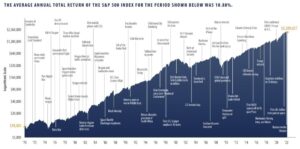

Remember that no investor can “time the market” so an asset allocation combined with rebalancing is your path to portfolio optimization and maximizing your investment returns.

In Closing:

We covered how to begin investing as a Boglehead in 4 steps. How to get your financial portfolio investment strategy basics in place.

Following the Boglehead’s methodology has been a successful path for many investors as its simple and proven, with a well documented “blueprint for success”.

Use AssetRise for free using this link. Provide us feedback on what additional features you need to optimize your investment journey.