Key Highlights

- Day trading and long-term investing are two different strategies for generating returns in the financial markets.

- Day trading involves buying and selling financial securities within the same day, aiming to profit from short-term price movements.

- Long-term investing, on the other hand, involves holding securities for an extended period, often years or decades, to benefit from long-term growth and compounding interest.

- Day trading offers the potential for quick profits and allows for flexibility and control over trades.

- Long-term investing offers the benefits of compounding interest and growth, as well as reduced stress and time commitment.

- However, day trading carries risks such as market volatility and potential losses, while long-term investing has its own challenges, including market fluctuations and the need for patience.

- At AssetRise we use the Vanguard Boglehead approach to Long Term Investing buy and hold.

Introduction

In the world of financial markets, there are two popular strategies for generating returns: day trading and long-term investing. Both approaches have their own set of advantages and disadvantages, and understanding them can help determine which strategy is best suited for individual financial goals and risk tolerance.

Day trading involves buying and selling financial securities, such as stocks or currencies, within the same trading day. The goal of day trading is to profit from short-term price movements in the market. Day traders rely on technical analysis and market trends to identify opportunities for quick profits. They often use leverage or borrowed capital to amplify their trading positions, which can result in higher returns but also increase the risk of losses.

On the other hand, long-term investing focuses on buying and holding securities for an extended period, often years or even decades. Long-term investors aim to benefit from the growth of their investments over time, taking advantage of compounding interest and the potential for capital appreciation. Long-term investing requires a more passive approach and a thorough understanding of the fundamentals of the companies or assets being invested in.

Both day trading and long-term investing have their own pros and cons, and it is important to carefully consider these factors before deciding which strategy to pursue. This blog will explore the key highlights, benefits, and risks associated with each approach to help readers make informed decisions about their investment strategies.

Understanding Day Trading and Long Term Investing

When it comes to navigating the financial markets, it is crucial to understand the differences between day trading and long-term investing. These two strategies have distinct characteristics and time horizons that can significantly impact investment outcomes.

Day trading is an active trading style that involves buying and selling financial securities within the same day. Day traders aim to profit from short-term price movements in the market, often relying on technical analysis and market trends to identify potential opportunities. The time horizon for day trading is typically very short, ranging from minutes to hours. Day traders need to closely monitor the market throughout the trading day and make quick decisions based on price fluctuations.

In contrast, long-term investing takes a more passive approach. Long-term investors buy and hold securities for an extended period, often years or even decades. The primary goal of long-term investing is to benefit from the growth of investments over time, taking advantage of compounding interest and capital appreciation. Long-term investors typically focus on the fundamentals of the companies or assets they invest in, looking for stable growth potential and financial stability.

Both day trading and long-term investing require an understanding of the financial markets and the factors that drive price movements. However, the time horizon and approach are what sets these strategies apart. Day trading offers the potential for quick profits but requires active monitoring and quick decision-making. Long-term investing, on the other hand, allows for a more patient and passive approach, aiming to benefit from long-term growth.

Defining Day Trading: A Brief Overview

Day trading is a form of active investing that involves buying and selling financial securities within the same trading day. Day traders, also known as active traders or intraday traders, aim to profit from short-term price fluctuations in the stock market or other financial markets.

The trading strategy of day traders revolves around taking advantage of intraday price movements to generate profits. Day traders often rely on technical analysis, which involves studying price charts, patterns, and indicators to identify potential trading opportunities. They use various trading strategies, such as scalping or momentum trading, to capitalize on short-term market trends.

Day trading requires a high level of focus, discipline, and risk management. Day traders need to closely monitor the market, react quickly to price changes, and make timely trading decisions. They often use leverage or borrowed capital to magnify potential returns, but this also increases the risk of losses. Day trading can be highly profitable, but it is also associated with higher risks and requires a thorough understanding of the trading strategies and market dynamics.

The Essentials of Long Term Investing

Long-term investing involves buying and holding securities for an extended period, often years or even decades. The primary goal of long-term investing is to benefit from the growth of investments over time, taking advantage of compounding interest and capital appreciation.

Jack Bogle, founder of Vanguard Investments, uses a simple, low cost Index Fund Portfolio that generates long term returns without the risk of day trading. Learn how to invest in Index Funds using the “Bogleheads” method.

Passive investing is a common approach to long-term investing, where investors build a diversified portfolio of assets and hold onto them for an extended period. This strategy aims to achieve market returns by investing in low-cost index funds or mutual funds that track a specific market index.

The holding period for long-term investing is significantly longer than that of day trading. Investors typically hold onto their investments for years or even decades, allowing time for the investments to grow in value and generate returns. Asset allocation, or the distribution of investments across different asset classes, is an essential aspect of long-term investing. A diversified portfolio can help reduce risk and enhance long-term returns.

Long-term investing requires a patient and disciplined approach. Investors need to have a long-term financial plan in place and be comfortable with the potential volatility of the market. It is important to regularly review and rebalance the portfolio based on changing market conditions and individual financial goals.

Analyzing the Benefits of Day Trading

Day trading offers several potential benefits for traders who are willing to take on the associated risks. Some of the key advantages of day trading include the potential for quick profits and the flexibility and control over trades.

Potential for Quick Profits

One of the main benefits of day trading is the potential for quick profits. Day traders aim to take advantage of short-term price fluctuations in the market to generate profits. By buying and selling securities within the same day, day traders can capitalize on intraday price movements and potentially make significant gains in a short period.

The short-term nature of day trading allows for capital gains to be realized quickly. Day traders can enter and exit trades within minutes or hours, taking advantage of short-term price trends and market inefficiencies. This can lead to high returns on investment if successful.

To successfully day trade, traders often rely on advanced trading platforms that provide real-time market data, charting tools, and order execution capabilities. These platforms enable day traders to make quick, informed decisions and execute trades with minimal delay. The potential for quick profits and the ability to react swiftly to market movements are some of the key advantages of day trading.

Flexibility and Control Over Trades

Day trading also offers the flexibility and control over trades that may not be available in other investment strategies. Day traders have the freedom to choose which stocks or securities to trade, when to enter and exit positions, and how much capital to allocate to each trade.

Day traders often use technical analysis to identify potential trading opportunities. They analyze price charts, patterns, and indicators to make informed decisions about when to buy or sell securities. This level of analysis and control over trades allows day traders to take advantage of short-term market trends and potentially profit from price fluctuations.

Another advantage of day trading is the ability to react quickly to market volatility. Day traders can adjust their trading strategies in real-time based on changing market conditions, news events, or technical indicators. This flexibility and control over trades provide day traders with the opportunity to capitalize on short-term market movements and potentially generate consistent profits.

Exploring the Advantages of Long Term Investing

Long-term investing offers several advantages for investors who are willing to take a more patient and passive approach. Some of the key benefits of long-term investing include the potential for compounding interest and growth, as well as reduced stress and time commitment.

Compounding Interest and Growth

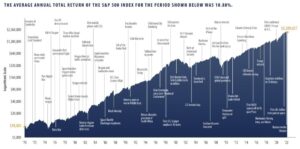

One of the main advantages of long-term investing is the potential for compounding interest and growth. When investments generate returns, those returns can be reinvested to generate additional earnings. Over an extended period, the compounding effect can significantly enhance the total return on investment.

The longer the holding period, the greater the potential for compounding interest and growth. By staying invested in the market for years or even decades, investors can benefit from the long-term upward trajectory of the market and the power of compounding.

Long-term investing requires a comprehensive financial plan that takes into account individual financial goals, risk tolerance, and time horizon. By adhering to a long-term plan and staying invested in the market, investors can benefit from the potential for compounding interest and growth.

Reduced Stress and Time Commitment

Another advantage of long-term investing is the reduced stress and time commitment compared to day trading. Long-term investors do not need to closely monitor the market or make frequent trading decisions. This can lead to reduced stress and a better quality of life.

Long-term investing allows investors to take a more passive approach to their investments, focusing on the long-term performance rather than short-term market fluctuations. This can help reduce the emotional stress often associated with day trading, where decisions need to be made quickly and market volatility can be intense.

In addition, long-term investing requires less time commitment compared to day trading. Investors can research and select their investments, create a diversified portfolio, and then monitor the portfolio on a less frequent basis. This can free up time for other activities and priorities, enhancing the overall quality of life.

The Risks Associated with Day Trading

While day trading offers the potential for quick profits, it also carries certain risks that traders need to be aware of. Some of the key risks associated with day trading include market volatility and the potential for losses, as well as high costs and fees that can impact returns.

Market Volatility and Losses

One of the main risks of day trading is market volatility. The stock market can experience significant price fluctuations within a single trading day, creating both opportunities and risks for day traders. Market volatility can result in rapid price movements that can lead to losses if trades are not timed correctly.

Day traders are exposed to financial risk due to the short-term nature of their trades. They need to accurately predict price movements and execute trades at the right time to generate profits. If trades are not successful, day traders can incur losses.

The capital markets are influenced by various factors, such as economic indicators, corporate earnings reports, geopolitical events, and investor sentiment. These factors can contribute to market volatility and impact stock prices. Day traders need to closely monitor market conditions and be prepared to react quickly to changes in order to mitigate the risk of losses.

High Costs and Fees Impacting Returns

Day trading can also be associated with high costs and fees that can impact overall returns. Traders need to consider transaction costs, such as commissions and fees charged by brokerage platforms, which can eat into profits.

Furthermore, day traders who use margin or borrowed capital for trading need to be aware of the associated costs and risks. Margin accounts can amplify potential returns, but they also increase the risk of losses and require interest payments on the borrowed capital.

In addition, day traders need to consider the tax implications of their trades. Short-term capital gains tax rates are typically higher than long-term capital gains tax rates, potentially reducing overall profitability.

It is important for day traders to carefully consider the costs and fees associated with day trading and factor them into their trading strategies to ensure that potential profits are not eroded by expenses.

The Challenges of Long Term Investing

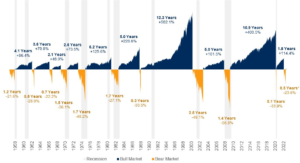

While long-term investing offers the potential for compounding interest and growth, it also presents its own set of challenges that investors need to navigate. Some of the key challenges of long-term investing include market fluctuations and the need for patience.

Market Fluctuations and Investment Patience

Market trends play a significant role in both day trading and long-term investing. Day traders closely monitor market fluctuations and capitalize on short-term price movements. They rely on technical analysis tools and indicators to identify patterns and make quick decisions. On the other hand, long-term investors focus on the overall performance of asset classes and the potential for growth over time.

One key difference between the two strategies is the level of investment patience required. Day traders are looking for immediate results and are willing to buy and sell securities within a single day. They need to have a high tolerance for risk and the ability to adapt to fast-paced market conditions.

In contrast, long-term investors take a more patient approach. They understand that market fluctuations are a normal part of investing and are willing to hold onto investments for an extended period. Long-term investing allows for the potential to benefit from compounding returns and the overall growth of the market.

It’s important to note that both day trading and long-term investing can benefit from the guidance of a financial advisor. A financial advisor can provide valuable insights, help navigate market trends, and assist in creating a diversified portfolio that aligns with an individual’s investment goals and risk tolerance.

Diversification Strategy and Risk Management

Diversification and risk management play a crucial role in both day trading and long-term investing. Diversification involves spreading investments across different asset classes to minimize risk. In day trading, diversification can be achieved by trading multiple stocks or financial instruments to reduce the impact of any single trade. In long-term investing, diversification can be achieved by investing in a mix of stocks, bonds, and other asset classes. Risk management is also important in both strategies.

Day traders need to set stop-loss orders to limit potential losses and manage risk actively. Long-term investors need to assess their risk tolerance and allocate their assets accordingly. Understanding your risk tolerance and implementing appropriate risk management strategies can help mitigate the potential downsides of both day trading and long-term investing.

Comparative Analysis: Day Trading vs. Long Term Investing

When comparing day trading and long-term investing, several factors come into play. These include the time horizon, risk tolerance, capital requirements, and investment goals.

| Day Trading | Long-Term Investing |

Time Horizon | Short-term (intraday) | Long-term (years or decades) |

Risk Tolerance | High | Lower |

Capital Requirements | Significant | Varies |

Investment Goals | Quick Profits | Long-term Growth and Income |

In day trading, the time horizon is short-term, typically within the same trading session. Traders aim to profit from the intraday price movements of stocks or other financial instruments. Long-term investing, on the other hand, involves a longer time horizon, often spanning years or even decades. Investors focus on the long-term growth and income potential of their investments.

Day trading requires a higher level of risk tolerance as traders are exposed to significant market volatility and the potential for rapid financial loss. Long-term investing typically has a lower risk tolerance as investors have more time to recover from market downturns and can benefit from the compounding effect of their investments over time.

Day trading also requires significant capital, as traders often utilize leverage and margin accounts to amplify their potential profits and losses. Long-term investing can be done with varying amounts of capital, depending on the individual’s financial situation and investment goals.

The investment goals of day trading are typically focused on quick profits. Traders aim to take advantage of short-term price fluctuations to generate returns. Long-term investing, on the other hand, is more focused on long-term growth and income. Investors seek to build wealth over time through the appreciation of their investments and the receipt of dividends.

Ultimately, the choice between day trading and long-term investing depends on your individual circumstances, financial goals, risk tolerance, and time commitment. It’s important to carefully consider these factors and consult with a financial advisor before making any investment decisions.

Time Horizon and Investment Goals

The time horizon and investment goals are significant factors to consider when choosing between day trading and long-term investing. Day trading has a short time horizon, often intraday, where traders aim to profit from short-term price movements. The goal of day trading is to generate quick profits by taking advantage of market fluctuations. On the other hand, long-term investing has a much longer time horizon, spanning years or even decades. The investment goals of long-term investing are focused on long-term growth and income. Investors aim to build wealth over time through the appreciation of their investments and the receipt of dividends. Understanding your time horizon and investment goals can help you determine which strategy aligns better with your financial objectives.

Risk Tolerance and Capital Requirements

Risk tolerance and capital requirements are important considerations when deciding between day trading and long-term investing. Day trading requires a high level of risk tolerance as traders are exposed to significant market volatility and the potential for rapid financial loss. Traders need to be comfortable with the potential ups and downs of the market and be able to handle the emotional and psychological aspects of trading. Additionally, day trading often requires significant capital as traders need to meet margin requirements and have enough funds to cover potential losses. On the other hand, long-term investing typically has a lower risk tolerance as investors have more time to recover from market downturns and can benefit from the compounding effect of their investments. The capital requirements for long-term investing can vary depending on the individual’s financial situation and investment goals. Professional investors often have larger capital bases to work with, allowing them to take on more significant positions in the market. Considering your risk tolerance and capital requirements can help you determine which strategy is more suitable for your financial situation.

Making the Choice: Which Strategy Suits You?

Choosing between day trading and long-term investing ultimately depends on your financial situation, risk appetite, investment knowledge, and trading strategy. Here are some factors to consider when making the choice:

- Financial Situation: Assess your financial situation, including your income, savings, and overall financial stability. Day trading often requires a significant amount of capital, while long-term investing can be done with smaller amounts. Consider how much money you are willing and able to invest.

- Risk Appetite: Determine your risk appetite and tolerance. Day trading involves higher risks due to the short-term nature of trades and potential for significant financial losses. Long-term investing allows for a more conservative approach, with the potential for slower but steadier returns.

- Investment Knowledge: Evaluate your investment knowledge and experience. Day trading requires a deep understanding of market trends, technical analysis, and the ability to make quick decisions. Long-term investing relies more on fundamentals and requires a thorough understanding of the companies and industries in which you are investing.

- Trading Strategy: Consider your preferred trading strategy. Day trading involves actively buying and selling securities within the same day, while long-term investing involves holding onto investments for an extended period of time. Determine which strategy aligns better with your trading style and preferences.

It is important to note that both day trading and long-term investing have their pros and cons. Day trading can provide the excitement of quick profits but comes with higher risks and requires significant time commitment and expertise. Long-term investing allows for a more passive approach, but requires patience and a long-term perspective.

Ultimately, the choice between day trading and long-term investing should be based on your individual financial goals, risk tolerance, and trading preferences. It may be beneficial to consult with a financial advisor who can provide personalized guidance and help you make an informed decision.

Assessing Your Financial Situation and Objectives

When considering whether day trading or long-term investing is the right strategy for you, it’s important to assess your financial situation and objectives. Start by creating a comprehensive financial plan that outlines your income, expenses, savings, and investment goals. Determine how much money you are willing and able to invest, taking into account your current financial obligations and responsibilities. Evaluate your credit score, as this can impact your ability to obtain loans or access certain investment opportunities. Consider your short-term and long-term financial goals, such as saving for retirement, buying a house, or funding a child’s education. Assessing your financial situation and objectives will help you determine whether day trading or long-term investing aligns better with your personal finance goals.

Considering Your Risk Appetite and Investment Knowledge

When deciding between day trading and long-term investing, it’s crucial to consider your risk appetite and investment knowledge. Evaluate your risk tolerance and determine how comfortable you are with potential losses. Day trading involves higher risks and requires a higher risk tolerance, as trades are often executed quickly and market volatility can lead to significant financial losses. On the other hand, long-term investing allows for a more passive approach and generally carries a lower level of risk.

Assess your investment knowledge and expertise in both active and passive investing strategies. Day trading requires a deep understanding of market trends, technical analysis, and the ability to make quick decisions. Long-term investing relies more on fundamentals and the ability to identify companies with long-term growth potential. Consider your risk appetite and investment knowledge when making the choice between day trading and long-term investing.

Conclusion

In conclusion, the decision between long-term investing and day trading ultimately depends on your financial goals, risk tolerance, and time commitment. Day trading offers the potential for quick profits but comes with higher risks and costs. On the other hand, long-term investing provides the benefits of compounding interest and reduced stress but requires patience and a diversified portfolio. Assess your objectives, financial situation, and risk appetite before choosing the strategy that aligns best with your investment style. Remember, both strategies have their pros and cons, so it’s crucial to make an informed decision based on your individual circumstances.

Frequently Asked Questions

What Amount of Capital Is Recommended to Start Day Trading?

The amount of capital recommended to start day trading varies depending on individual circumstances and trading goals. Generally, it is advisable to have a minimum of $25,000 in capital to meet the Pattern Day Trader (PDT) rule, which requires a minimum account balance to day trade with margin. However, traders can start with smaller amounts, but it may restrict the number of day trades they can make within a specific time frame.

How Long Should I Hold Investments to Be Considered a Long Term Investor?

To be considered a long-term investor, holding investments for more than a year is typically recommended. This duration allows for potential growth and benefits from factors like compounding interest. However, individual financial goals and risk tolerance should also influence the holding period.

Can Day Trading and Long Term Investing Strategies Coexist in a Portfolio?

Yes, day trading and long-term investing strategies can coexist in a portfolio. However, it requires careful planning and risk management to maintain a diversified portfolio that balances the short-term trading activities with the long-term investment goals. It is important to have a comprehensive financial plan that aligns with both strategies.

What Are the Tax Implications of Day Trading vs. Long Term Investing?

The tax implications of day trading and long-term investing differ. Day traders are subject to short-term capital gains tax, which is taxed at the individual’s ordinary income tax rate. Long-term investors may benefit from lower tax rates on their profits if their investments are held for more than one year and qualify for long-term capital gains tax rates, which can be 0%, 15%, or 20% depending on the investor’s income levels.

About AssetRise

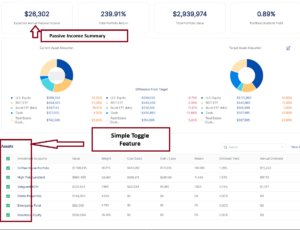

At AssetRise we believe in the Vanguard Bogleheads principles of Index Investing.

The AssetRise tool provides portfolio rebalancing, dividend projections, and portfolio return for all your investment accounts in a single dashboard. Add 2 accounts for free.

Add your first 2 portfolios for FREE. AssetRise provides the industry leading portfolio rebalance calculator.

Disclaimer: the information in this article is for information and research purposes only. It does constitute financial advice.