The Benefits of Tax Loss Harvesting Explained

Tax loss harvesting is a tax strategy that can help investors minimize their tax liability and increase their after-tax investment returns. By strategically selling securities at a loss, investors can offset taxable gains and reduce the taxes owed to the government.

This practice can be particularly beneficial for individuals who have realized capital gains throughout the year and are looking for ways to lower their tax bill. In this blog, we will explore the concept and basic principles of tax loss harvesting, how it works, its role in investing, key factors to consider, restrictions, when to utilize it, the process involved, and whether it is a long-term solution or a temporary fix. Many Bogleheads leverage these concepts, we recommend you read Bogleheads Guide to Investing for a foundation on the Bogleheads Method.

Understanding Tax Loss Harvesting

Before diving into the details, let’s first establish a clear understanding of tax loss harvesting. Simply put, tax loss harvesting involves selling securities, such as stocks or mutual funds, that have declined in value, in order to offset capital gains and reduce taxes.

The basic concept is to strategically sell losing investments to balance out gains, allowing investors to minimize their tax liability. It’s important to note that tax loss harvesting can only be done within the same tax year, and the losses can be used to offset gains realized in that year.

Definition and Basic Concept of Tax Loss Harvesting

Tax loss harvesting is a tax strategy that allows investors to strategically use losses from investment securities to offset taxable gains, thereby reducing their tax liability. The basic concept behind tax loss harvesting is to sell securities that have declined in value, known as capital losses, to offset capital gains realized during the tax year.

By utilizing tax loss harvesting, investors can lower their taxable income and potentially reduce their tax bill. The tax savings generated from tax loss harvesting can be significant, especially for individuals in higher tax brackets. This strategy enables investors to take advantage of capital losses to offset investment gains, reducing the taxes owed to the government.

Tax loss harvesting is a valuable tax strategy that can be utilized by investors to minimize tax liability and increase overall tax savings. By strategically selling securities at a loss, investors can offset taxable gains, resulting in lower tax payments. This tax strategy forms an essential part of an investor’s tax planning, allowing them to optimize their tax savings and maximize after-tax investment returns.

Tax loss harvesting can be particularly beneficial in years when an investor has realized significant investment gains, as it provides a means to offset those gains and lower the tax bill. By intentionally realizing capital losses, investors can reduce their taxable income, potentially putting them in a lower tax bracket and saving on taxes owed.

How Tax Loss Harvesting Works

By strategically selling losing investments to offset gains, tax loss harvesting works to lower taxes. It involves identifying securities with losses and selling them to offset taxable gains, intentionally realizing investment losses to minimize taxes.

The technique reduces tax liability by using investment losses. This method is employed to strategically lower taxes through the intentional realization of investment losses, to reduce tax liability.

The Role of Tax Loss Harvesting in Investing

Tax loss harvesting plays a crucial role in optimizing investment income and managing tax liability. By strategically selling assets at a loss, investors can offset taxes on both gains and ordinary income.

Understanding one’s marginal tax rate is essential for implementing this approach effectively. It allows investors to defer taxes and free up cash for reinvestment, thereby potentially increasing the annual return. Furthermore, tax-loss harvesting can be particularly advantageous for high-net-worth individuals in higher tax brackets or those with significant net investment income tax.

As part of investment advice, considering tax-loss harvesting for individual securities, mutual funds, or retirement accounts is a prudent practice to mitigate future gains and manage the current tax bill effectively.

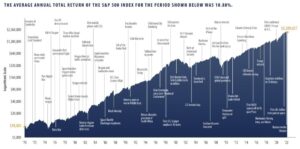

Impact on Investing Returns

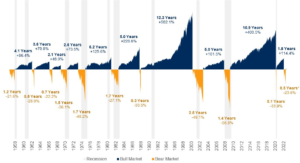

Minimizing tax liability through tax loss harvesting can have a significant impact on investment returns. By strategically offsetting gains with losses, this approach maximizes after-tax investment income, contributing to greater overall returns.

The tax efficiency achieved through this strategy can be particularly beneficial, as it helps reduce the current tax bill and may also lower future gains’ tax impact. Overall, tax loss harvesting plays a crucial role in enhancing investment returns by optimizing tax outcomes.

Using Tax Loss Harvesting to Offset Gains

Strategically utilizing investment losses to counterbalance taxable gains allows investors to minimize taxes. By intentionally realizing losses, investors can offset gains and reduce tax liability. This technique involves leveraging investment losses to offset taxable gains, providing a silver lining to the otherwise challenging task of managing tax liability.

By using tax loss harvesting, investors can effectively manage their current tax bill and potentially reduce future gains’ impact on their taxable income. This strategy is instrumental in minimizing taxes and maximizing annual return on investment income without violating any legal aspects of the tax code.

Key Factors to Consider in Tax Loss Harvesting

Capital losses can offset capital gains, reducing the investor’s current tax bill. Lowering the cost basis through tax loss harvesting can lead to a higher tax bill down the road. Short-term gains are taxed at higher rates than long-term gains, affecting the decision-making process in tax-loss harvesting.

It’s crucial for investors to consider their income tax bracket when planning tax-loss harvesting, as this impacts the potential tax savings. Understanding these key factors is essential for investors to make informed decisions when implementing tax loss harvesting strategies.

Capital Losses and Personal Income

When capital losses occur, they can help offset ordinary income, potentially leading to lower tax bills. These losses play a crucial role in reducing taxable income, thus impacting potential tax savings.

The impact of capital losses on personal income tax can be significant, allowing investors to reduce their taxable income and lower their tax liability. Understanding the relationship between capital losses and personal income is crucial for making informed financial decisions.

The Lower the Cost Basis, the Higher the Tax Bill

Understanding the impact of cost basis is crucial in tax loss harvesting. When gains are realized, a lower cost basis results in a higher tax bill. The relationship between cost basis and tax bill is an important consideration, as a lower cost basis can lead to increased tax liability when gains are realized.

It’s essential to note that lower cost basis can lead to unintended tax implications when gains are realized. This underscores the significance of cost basis in managing tax bills, making it a critical factor to consider when engaging in tax loss harvesting.

Short-Term vs. Long-Term Tax Rates

In tax loss harvesting, an understanding of short-term vs. long-term tax rates is crucial. The tax treatment of gains and losses hinges on these rates, with different tax rates applying to short-term and long-term capital gains. Recognizing the impact of these rates is vital in tax planning and plays a significant role in tax-efficient investment strategies. Moreover, it is important to consider the marginal tax rate and potential net investment income tax implications.

These factors can significantly affect the decision-making process when implementing tax loss harvesting strategies, especially for higher tax brackets and individuals with substantial investment income. In this context, seeking advice from investment managers or financial planners could provide valuable insights into optimizing tax outcomes and reducing the current tax bill.

Allowances and Restrictions on Tax-Loss Harvesting

When engaging in tax loss harvesting, investors must be aware of various allowances and restrictions. Understanding the impact on their investment income is crucial. It’s essential to consider the marginal tax rate and the potential for year-end tax planning. The Internal Revenue Service (IRS) has specific rules regarding tax-loss harvesting, especially when it involves mutual funds and individual securities. Investors should seek legal advice or consult a financial planner for guidance on navigating the tax code.

Additionally, the net investment income tax and the implications for retirement accounts play a significant role in the decision-making process. Considering these factors can help investors make informed decisions about tax loss harvesting without falling afoul of regulatory restrictions.

The Wash-Sale Rule

Investors should be aware of the wash-sale rule, which prohibits repurchasing similar securities within 30 days. Seeking guidance from a tax advisor can help in avoiding unintended tax implications and optimizing tax strategies for future gains. Violations of the wash sale rule can result in higher tax liabilities, making it crucial to understand capital gains taxes for compliance.

Additionally, tax advisors can offer assistance in tax strategy optimization for future tax years, ensuring that investors are well-informed about their investment income and individual securities. Understanding these rules is essential for any investment manager or individual stock investor to make informed decisions and avoid unnecessary tax implications, ultimately contributing to a more efficient investment strategy.

Other Regulatory Aspects

When considering tax-loss harvesting, it’s essential to understand the regulatory aspects for tax purposes. Tax advisors are instrumental in providing illustrative purposes and optimizing tax strategies for future gains. Moreover, understanding the remaining losses is crucial for future tax years. Tax advisors can offer guidance on compliance with the wash sale rule and provide valuable insights into tax strategy optimization.

This ensures that individuals and investors remain compliant with internal revenue regulations while maximizing their investment income and minimizing their net losses. Seeking advice from tax professionals can help in navigating the complex landscape of tax codes and regulations, offering a silver lining in managing current tax bills and future gains.

When to Utilize Tax Loss Harvesting

Tax loss harvesting can be utilized when an investor wants to offset their investment income and future gains. It can also be beneficial for individuals in higher tax brackets seeking to reduce their current tax bill. Additionally, tax loss harvesting can be a useful strategy for minimizing net investment income tax.

When Tax-Loss Harvesting Works

Tax advisors play a crucial role in maximizing tax savings through loss harvesting by offering advice on tax strategy optimization for future tax years.

Understanding tax brackets is essential for optimizing tax savings, and expert tax advisors can help determine the optimal tax year for tax-loss harvesting based on individual financial situations. Additionally, tax advisors provide valuable insight into tax purposes for investment gains, guiding individuals in making informed decisions for long-term financial growth. Their expertise in tax planning contributes to maximizing tax benefits and minimizing tax liabilities through strategic investment advice.

Situations Where Tax-Loss Harvesting May Not Work

In evaluating situations where tax-loss harvesting may not be suitable, the expertise of tax advisors is invaluable. Their guidance can offer insight into tax laws, ensuring optimal tax strategy and planning for future gains. Additionally, tax advisors can determine the most advantageous tax year for implementing tax-loss harvesting, aiding in tax strategy optimization for future tax years. By leveraging their expertise, individuals can make informed decisions regarding investment income and taxable gains, ultimately optimizing their financial position within the confines of the tax code.

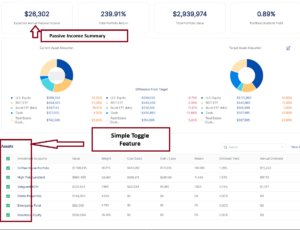

The Process of Tax-Loss Harvesting

The process of tax-loss harvesting involves several steps that can help investors minimize their tax burden. Firstly, it requires identifying investments in a taxable account that have experienced a decline in value. Next, these investments are sold to realize the losses, which can then be used to offset any capital gains in the portfolio.

After realizing the losses, investors can reinvest the proceeds in a similar role, allowing them to maintain their market exposure while simultaneously harvesting tax losses. It’s important to note that tax-loss harvesting should be done with careful consideration of the wash-sale rule, which prohibits repurchasing the same or substantially identical securities within 30 days. Additionally, investors should consult their investment manager or financial planner for personalized investment advice tailored to their specific tax situation.

Step-by-Step Guide to Implement Tax-Loss Harvesting

Tax advisors play a crucial role in tax-loss harvesting, offering illustrative purposes and helping investors understand the implications of capital losses. Understanding transaction costs is essential for tax optimization, and tax advisors can assist in strategizing for future tax years. They also provide valuable advice on tax implications for remaining losses. By leveraging their expertise, investors can navigate the complexities of tax codes, income tax brackets, and net investment income tax.

Ultimately, tax advisors help in optimizing tax deferral, minimizing current tax bills, and maximizing future gains through efficient tax-loss harvesting strategies, ensuring that investors stay informed and make well-informed decisions for their investment income.

Is Tax-Loss Harvesting a Long-Term Solution or a Temporary Fix?

Tax advisors can provide valuable insights on tax strategy optimization for future tax years, helping you understand the long-term implications of tax-loss harvesting. They can determine the suitability of this strategy based on your individual circumstances and offer advice on maximizing tax savings through loss harvesting. Ultimately, tax advisors can guide you in making informed decisions that align with your long-term investment goals and tax purposes.

Frequently Asked Questions

What is tax loss harvesting

Tax loss harvesting is a strategy used to offset gains and reduce taxes by selling losing investments. It involves strategically selling investments at a loss to balance out capital gains in a portfolio. This practice can be done manually or through automated investment services and can save investors money on taxes while increasing overall portfolio returns.

How does tax loss harvesting work

Tax loss harvesting works by selling investments that have decreased in value to offset gains on other investments. By doing this, you can reduce your tax liability for the year. The sold investments can be replaced with similar ones for future growth potential. Implementing tax loss harvesting strategically and with a long-term investment plan can maximize its benefits.

How to tax loss harvest

Tax loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxes. Throughout the year, look for opportunities to sell investments that have decreased in value. Remember to avoid violating the wash-sale rule by not repurchasing the same or substantially similar investment within 30 days. Consult with a financial advisor or tax professional for personalized advice.

Is tax loss harvesting worth it

Tax loss harvesting can be a valuable strategy for reducing taxes on investment gains. Determining if it’s worth it depends on your individual financial situation and tax bracket. Consider the potential benefits and costs before implementing it, and consult with a financial advisor or tax professional for personalized advice.

Conclusion

In conclusion, tax loss harvesting is a valuable strategy that can help investors maximize their returns and minimize their tax liabilities. By offsetting gains with losses, individuals can effectively lower their taxable income and potentially increase their after-tax returns. This is where the Benefits of Tax Loss Harvesting become valuable for investors.

However, it’s important to consider several key factors, such as personal income, cost basis, and tax rates, before implementing tax loss harvesting. Additionally, understanding the allowances and restrictions, such as the wash-sale rule, is crucial to ensure compliance with regulations.

While tax loss harvesting can be a powerful tool, it’s essential to evaluate whether it aligns with your long-term investment goals. Consulting with a financial advisor or utilizing fintech platforms can simplify the process and provide guidance on the suitability of tax loss harvesting for your specific situation.

Disclaimer: the information in this article is for information and research purposes only. It does constitute financial advice.