What does it mean to be a “Boglehead” Investor?

A “Boglehead” is an investor who follows investing principles of Jack Bogle, founder of Vanguard Investments using low cost ETF’s like VTI. The purpose of this blog post is to outline the investment principles of a Boglehead Investor.

Boglehead Investing Principles

These principles are based on patience, discipline, and the power of compounding interest. They are designed to help investors achieve their financial goals over the long term.

Before you jump into buying stocks and bonds, invest time into your PLAN upfront before you jump into buying stocks and bonds. Now, let’s break down each of these principles including how I’ve applied them to my investing success.

Develop a Workable Plan

A workable plan is a comprehensive financial plan that is tailored to your financial goals and risk tolerance. It should include a budget, an emergency fund, and a retirement plan. The plan should be reviewed and updated regularly to ensure that it remains relevant.

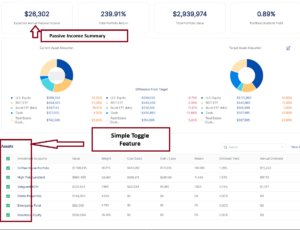

Each Boglehead develops a unique plan called an IPS. An Investment policy statement (IPS) is a statement that defines your general investment goals and objectives. It describes the strategies that you will use to meet these objectives, and contains specific information on subjects such as asset allocation, risk tolerance, and liquidity requirements.

The first step in investing as a Boglehead is to write down your IPS then stick to it. This will be critical as you navidate the highs and lows of investing.

Here is an IPS example for you to use

| Investment philosophy: | “Buy-and-hold, long-term, all-market-index strategies, implemented at rock-bottom cost, are the surest of all routes to the accumulation of wealth” – John C. Bogle |

|---|---|

| Asset allocation: | Maintain overall 60% stock + 40% fixed-income allocation until home purchase to accommodate both short-term and long-term requirements. Assets should be diversified across major asset classes including domestic equity, international equity (20-25% of equities), conventional bonds of short to intermediate term, and TIPS (50% of fixed). |

| Funds and accounts: | Use low cost mutual funds – index funds preferably – which do not overlap and provide maximum diversification across asset classes. Try to assume only market risk as far as possible. Try to shelter tax-inefficient funds in tax-advantaged accounts to reduce tax drag. |

| Target allocation: |

|

| Other considerations: | Automate future contributions wherever possible. Rebalance yearly. No market timing. Exact sub-allocations are not as important as maintaining the overall 60/40 stock/fixed allocation – no need to make things complex in order to meet sub-allocation targets. |

Too many investors fail since they have no plan. They simply jump into buying the latest stock or chase past performance. Nobody can predict the future, so build you plan and stick to it.

Invest Early and Often

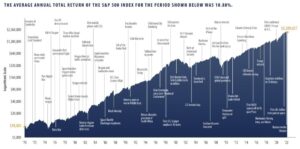

Once you have a regular savings pattern, you can begin accumulating financial wealth. How much saving is enough? For retirement, 20% of income may be a good starting point, but this will vary widely from person to person. If you want to be retire before age 65, or plan to leave significant assets to charity or to children, you probably need to save even more. Starting a regular savings plan early in life is important because investment returns compound over a longer period.

The image below demonstrates the benefit of starting early.

The best way to save money is to arrange automatic deductions from your paycheck. Many 401(k)s offer this. When you invest in an IRA or taxable account, choose a provider that will automatically deduct money from your bank account the day after pay day. This is described as “paying yourself first,” and it goes a long way towards establishing and reinforcing reasonable spending habits.

There are guidelines for which accounts you should fund and in what order. But always remember, you first need to save the money. When you start, saving regularly is more important than your choice of investments.

Bearing Risk

Your risk tolerance is your ability to stick to an investment plan through difficult financial and market conditions. To know if an asset allocation matches your risk tolerance, ask yourself if you held it, would you sell during the next bear market? This is very hard to answer honestly before you have experienced one.

In Bogleheads investing philosophy, it’s important to invest in a way that is appropriate for your financial situation and goals . This means that you should never bear too much or too little risk. Investing too conservatively can result in lower returns, while investing too aggressively can lead to higher risk and potential losses.

To determine the appropriate level of risk for your investments, you should consider your financial goals, time horizon, and risk tolerance. If you’re investing for a long-term goal, such as retirement, you may be able to tolerate more risk than if you’re investing for a short-term goal, such as a down payment on a house. It’s important to find a balance between risk and reward that is appropriate for your individual situation.

To give you enough money for retirement, you want assets with a decent expected return. This means you need to own stocks. Stocks return a share of the profits generated by publicly owned companies. But although they offer a chance of good returns, stocks are volatile and risky. In 2008, some markets fell 50% from their previous highs. Over time, stock prices roughly follow the trend of the economy, which is to grow. But prices can stagnate or decline for decade-long periods. This is why your asset allocation needs to include bonds as well as stocks. Boglehead philosophy is to buy stocks in a well diversified, low cost Index Fund.

The most popular stock fund is the Vanduard VTI ETF: Vanguard Total Stock Market Index Fund ETF consisting of over 3,000 U.S. stocks.

Bonds are a promise to pay back a loan of money on a set schedule. Bonds do not have the expected returns of stocks, but they are much less volatile. A mix of stocks and bonds will produce reasonable growth while limiting the size of the inevitable drops. How much in bonds? This is the basic question of asset allocation. Before you decide, you first need to balance your ability, willingness, and need to take risk. The more risk you can handle, the less bonds you need. When you are young, your prime earning years lie ahead, and it will be decades before you need to access the money. So, higher stock allocations may be suitable, because big drops in stock prices will not hurt as long as you do not sell during the drop.

John Bogle wrote:[2]

[A]s we age, we usually have (1) more wealth to protect, (2) less time to recoup severe losses, (3) greater need for income, and (4) perhaps an increased nervousness as markets jump around. All four of these factors suggest more bonds as we age.

— Common Sense on Mutual Funds, John Bogle

Although your exact asset allocation should depend on your goals for the money, there are a few general guidelines that you can follow. These are based on practice rather than on theory, and are only a starting point for decision making, not the end.

Although your exact asset allocation should depend on your goals for the money, there are a few general guidelines that you can follow. These are based on practice rather than on theory, and are only a starting point for decision making, not the end.

For example, Benjamin Graham wrote:[3]

We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequence inverse range of 75% to 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums.

— Quoted in The Intelligent Investor, Jason Zweig

Alternatively, John Bogle recommends “roughly your age in bonds“. For instance, if you are 45, 45% of your portfolio should be in high-quality bonds. He describes the idea as just “a crude starting point” which “[c]learly … must be adjusted to reflect an investor’s objectives, risk tolerance, and overall financial position“. He also suggests that you should treat any national or state retirement income you might receive as if it is a bond, setting its assumed value appropriately.

This “age in bonds” and its variants, age minus ten years or age minus twenty years, are only approximate starting points. You will probably want to adjust them to fit your circumstances. For example, if you have a guaranteed state or other pension, this changes both your need and your willingness to take risk. Some investors do not add pensions and Social Security to their asset allocation of bond holdings.

It is easy to underestimate risk and to overestimate your tolerance for risk. In 2008, many people learned too late that they should have been holding more bonds. Think carefully before choosing an asset allocation with high stock market allocations. If you have not been through a major market downturn before, your abstract logical thoughts about risk can quickly become emotional ones. The developing field of neuroeconomics explains how mental traits and emotional effects that work well in other areas undermine our ability to deal rationally with markets and investing.

You should generally own bond funds instead of individual bonds, for convenience and diversification. Using individual corporate or municipal bonds require a very large holding in order to achieve the broad diversification and increased safety of a bond fund. The high number of different bonds in bond funds lets you ignore the risk of any one bond defaulting. You can manage Interest rate risk by choosing funds with short and intermediate-term duration, and default risk by choosing funds with high credit ratings. The idea here is for your bond holdings to reduce violent up and down swings in overall portfolio value. You want your risks on the equity side, not the bond side.

The most popular Bogleheads bond fund is the ETF BND: Vanguard Total Bond Market for its low cost and diversification.