Generate Passive Income with Index Funds

Passive income is a concept that has gained significant attention in recent years, as people are increasingly seeking financial freedom and stability. The idea of earning money with little effort, even while you sleep, sounds appealing to many individuals. And one way to achieve passive income is through index funds.

In this blog, we will explore the world of passive income and how investing in index funds can be a lucrative source of passive income.

Index Funds are an easy way to generate passive income as it requires a minimal amount of time. Bogleheads use the 3 Fund Portfolio for simple Index Fund Passive Income. Learn about the Bogleheads Guide to Investing in our blog article.

Understanding Passive Income

To understand passive income, we need to grasp the concept of income sources. Active income refers to the money you earn from your active involvement, such as working a regular job or running a business.

On the other hand, passive income refers to earnings received regularly with little effort, often requiring upfront investment in time, money, or resources. It can be generated from various sources, such as rental income, dividends, interest, and capital gains from investments. Passive income allows individuals to earn money continuously, even when they’re not actively working.

Defining Passive Income

Passive income, also known as residual income, is money earned with little ongoing effort or active work. It is a stream of income that continues to flow in, even when an individual is not directly involved in work or business activities. This income stream allows individuals to earn money continuously, providing financial stability and freedom.

Passive income sources can come from various income streams, including real estate, stock market investments, online courses, digital products, affiliate marketing, and many more. These sources require upfront investment in time, money, or resources, but once set up, they can generate income without active involvement.

Passive income streams, powered by income sources, provide individuals with financial stability, as they possess the potential to generate extra cash flow. Unlike active income, passive income does not require exchanging time for money. Instead, it allows money to work for you, creating income even while you focus on other aspects of your life.

The Benefits of Passive Income

There are several benefits to generating passive income in addition to active income sources. Let’s explore some of the key advantages of passive income:

- Financial Stability: Passive income provides financial stability, reducing reliance on active income sources. Having passive income streams ensures a continuous flow of money, regardless of whether you’re actively working or not.

- Cash Flow: Passive income generates extra cash flow, which can be used to meet financial goals, pay off debts, invest in opportunities, or simply enjoy a better quality of life. It offers flexibility and financial freedom.

- Wealth Creation: Passive income opportunities provide the potential for wealth creation. By diversifying income sources, individuals can build long-term financial stability and accumulate wealth over time.

- Flexibility and Freedom: Passive income allows individuals to have more control over their time and priorities. It provides financial flexibility, giving you the freedom to pursue your passions, spend time with loved ones, or explore other opportunities.

- Long-Term Benefits: Passive income is not just about immediate financial gains. It offers long-term benefits, as income sources continue to generate money over time, providing a reliable income stream for the future.

- Overall, passive income is an effective way to create additional income, helping individuals achieve financial goals, gain financial freedom, and enjoy a better quality of life.

Index Funds as a Source of Passive Income

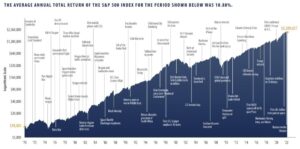

Index funds serve as a reliable source of passive income for investors seeking long-term growth and stability. These funds are designed to replicate the performance of a specific financial market index, such as the S&P 500, providing diversification and minimizing individual stock risk. By investing in index funds, individuals can benefit from the consistent returns associated with the overall market performance, making it an attractive option for passive income generation.

Furthermore, index funds offer a cost-effective investment approach with lower expense ratios compared to actively managed funds, optimizing returns for investors. The automated nature of index fund management reduces the need for constant monitoring and decision-making, making it a convenient option for those seeking minimal effort in managing their investments. With dividends and capital gains reinvested, index funds have the potential to steadily grow and provide a reliable source of passive income over time.

Learn more about ETF vs. Mutual Funds in this blog post.

What are Index Funds?

Index funds are investment vehicles that aim to replicate the performance of a specific financial market index, such as the S&P 500 or Dow Jones Industrial Average. They offer passive income opportunities by allowing investors to gain exposure to a diversified portfolio of stocks and securities. These low-cost mutual funds provide broad market diversification, making them an effective option for generating passive income and long-term financial growth.

Pros and Cons of Investing in Index Funds

Index funds present a cost-effective investment opportunity for those interested in passive income ideas. With low expense ratios, they offer an economically viable option for individuals looking to generate passive income. Additionally, these funds provide exposure to diversified market segments, effectively reducing the risk associated with individual stocks and enhancing the long-term stability of investments. What’s more, index funds allow passive income investors to adopt a hands-off approach, minimizing the need for active stock selection and management, making them an attractive option for those seeking a more passive investment strategy.

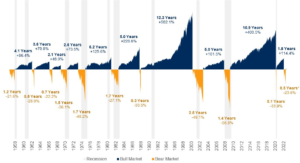

However, it’s important to note that market fluctuations and index volatility can impact the performance of these funds, potentially affecting passive income generation. Despite these risks, index funds remain popular among passive income seekers due to their potential for long-term wealth-building.

How Index Funds Generate Passive Income

Index funds contribute to passive income through various channels. Firstly, they generate passive income via dividend distributions, which represent a portion of profits distributed by companies in the fund’s portfolio. This allows investors to benefit from passive income opportunities as index funds comprise a diverse range of dividend-paying stocks and securities.

Additionally, the reinvestment of dividends in index funds enables compound growth, thereby enhancing long-term passive income generation and accumulation of wealth. Moreover, index funds also provide passive income through capital appreciation, as the underlying stocks and securities increase in value over time. Ultimately, investing in index funds offers an effective means of generating passive income by leveraging market returns and long-term investment opportunities.

Getting Started with Index Funds

Choosing the Right Index Fund:

When starting with index funds, it’s crucial to choose the right one. Look for low expense ratios and good historical performance to ensure a sound investment. Consider the fund’s holdings, as you want it to align with your investment goals and risk tolerance. Diversification is key when selecting an index fund to spread risk across various assets.

How to Invest in Index Funds:

Investing in index funds can be done through online brokerage accounts or financial advisors. Research and compare different platforms, considering factors like fees, minimum investment requirements, and available resources for education and support. Set up automatic investments to dollar-cost average over time, reducing the impact of market volatility. This strategy also encourages consistent investing without trying to time the market.

Managing Your Index Fund Investment:

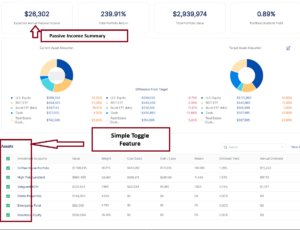

After investing in an index fund, regularly review its performance and make adjustments as needed. Rebalance your portfolio to maintain the desired asset allocation and consider tax implications when making changes. AssetRise provides the ultimate rebalance calculator.

Stay informed about market trends and economic developments to make well-informed decisions regarding your index fund investment.

Choosing the Right Index Fund

When selecting an index fund, investors should carefully assess the fund’s investment strategy, market index replication, and asset allocation. Key considerations such as expense ratios, fund management, and historical performance play a crucial role in determining the most suitable index fund. Additionally, evaluating the fund’s risk profile, market exposure, and sector diversification is essential to align with passive income goals and investment preferences. Understanding the fund’s investment philosophy, market tracking, and long-term income generation potential is pivotal in choosing the right index fund. Ultimately, the selection of index funds should align with passive income objectives, financial goals, and investment time horizon for sustainable wealth accumulation.

How to Invest in Index Funds

When considering how to invest in index funds, individuals should start by opening an investment account with a reputable brokerage firm. This account enables them to purchase shares of the chosen fund, providing a starting point for their investment journey. Whether through online platforms, financial advisors, or investment management firms, investing in index funds offers accessibility and convenience.

It is essential for individuals to allocate funds to index investments while considering asset allocation, investment goals, and long-term passive income objectives. Reviewing investment options, comparing fund features, and assessing expense structures are crucial steps when initiating index fund investments. Understanding the investment process, market entry points, and fund selection criteria is essential for successful passive income generation through index funds.

Managing Your Index Fund Investment

When managing your index fund investment, it’s essential to regularly evaluate the performance of your portfolio. Additionally, it’s crucial to adjust the asset allocation by rebalancing your index funds, ensuring that it aligns with your financial goals. Keeping an eye on the expense ratios associated with your index funds will help you make informed decisions about your investments.

Furthermore, considering the tax implications can optimize the overall profitability of your index fund investment. Staying up to date with market trends and economic indicators is imperative for making strategic investment moves and maximizing returns in the long run.

Other Passive Income Opportunities

Real-World Passive Income Ideas: Exploring Additional Opportunities

When exploring additional passive income opportunities, it’s essential to consider various avenues beyond traditional investments. Social media and a successful YouTube channel can generate passive income through sponsored content and ad revenue. Investing in an online store or selling stock photos on online marketplaces are also lucrative options. Furthermore, becoming an Airbnb host or investing in apartment complexes can provide a steady stream of passive income.

For those with little money to spare, affiliate programs offer the potential to earn passive income through quality content and minimal effort. Considering specific topics, such as financial advice or creating a successful blog, can establish a social media presence and drive affiliate links.

Moreover, developing a side hustle, like course content or a successful blog, can be a viable option for earning passive income.

Every $40k of side hustle income is equal to $1 million in retirement savings as explained in this blog.

Real Estate Investments

Real estate investments offer a reliable source of passive income through rental properties. Commercial real estate presents lucrative opportunities for generating passive income. When considering real estate investment trusts (REITs), it’s essential to evaluate their potential for consistent passive income. Exploring rental properties as part of a passive income strategy can provide a steady stream of earnings. Market conditions and location play a crucial role in identifying profitable real estate investment opportunities, making thorough assessment imperative.

Peer-to-Peer Lending

Diversifying your passive income portfolio with peer-to-peer lending offers an alternative source of revenue. It’s crucial to research the associated risks and benefits, considering factors such as the interest rate and creditworthiness of borrowers. Due diligence is essential when evaluating peer-to-peer lending opportunities for passive income. By incorporating peer-to-peer lending into your investment strategy, you can increase the resilience of your overall passive income stream. This route provides an opportunity to earn additional income outside of traditional investment vehicles, thereby bolstering your financial portfolio and potentially mitigating risks through a diversified approach.

Dividend Stocks

When considering passive income strategies, it’s essential to evaluate dividend stocks as a potential option. One should carefully assess the dividend yield and historical payments of stocks while also conducting thorough research on the financial stability of companies offering dividend stocks. Diversifying across different sectors can help mitigate risks when investing in dividend stocks, and understanding the influence of market conditions is crucial for making informed decisions. By incorporating dividend stocks into a diversified portfolio, individuals can potentially benefit from a steady stream of passive income.

Crowdfunding Real Estate

Crowdfunding real estate offers passive income opportunities through real estate projects. It involves researching various crowdfunding platforms to find suitable investment opportunities. Understanding the investment structure and terms is crucial when considering crowdfunding real estate. Additionally, it’s important to assess the risks and potential returns associated with these investments, as well as to consider the long-term outlook and exit strategy. This form of investment requires thorough consideration and due diligence to make informed decisions.

Building a Diverse Passive Income Portfolio

Importance of Diversification in Passive Investing

Diversifying your passive income portfolio is crucial for mitigating risk and maximizing returns. By spreading your investments across different asset classes, such as real estate, peer-to-peer lending, dividend stocks, and index funds, you can create a more stable and resilient income stream. This strategy helps protect your overall financial standing and ensures that a downturn in one investment does not significantly impact your entire passive income flow.

Balancing Index Funds with Other Investments

While index funds provide a reliable source of passive income, it’s essential to balance them with other opportunities. Real estate investments offer the potential for long-term appreciation, while peer-to-peer lending and dividend stocks can provide additional streams of passive income. By diversifying your portfolio in this way, you can enjoy the benefits of various passive income sources while managing risk effectively.

Importance of Diversification in Passive Investing

Diversifying your passive income investments is crucial for managing risk effectively. By allocating your resources across different asset classes, you can minimize the impact of market volatility and avoid overexposure to any single source of passive income. This strategic approach will help you mitigate risks in your investment portfolio, creating a more stable financial foundation.

Understanding the dynamics of diversified passive income investments is essential for long-term success. With the right diversification strategy, you can navigate market fluctuations and optimize the performance of your passive income streams, contributing to your overall financial security.

Balancing Index Funds with Other Investments

When balancing index funds with other investments, it’s essential to consider their role within a diversified passive income portfolio. Evaluating the correlation of index funds with other passive income sources helps in achieving a well-diversified portfolio. Assessing the risk-return tradeoff of index funds in relation to other investments is crucial for achieving a balanced passive income portfolio by incorporating various investment opportunities. Achieving this balance allows for the optimization of passive income streams, leading to a more stable financial future.

Risks and Challenges in Passive Income Investing

Investing in passive income opportunities comes with various risks and challenges that should be carefully considered. Understanding the potential downsides is crucial for making well-informed decisions. Common risks associated with passive income include market volatility, liquidity issues, and potential investment scams. Mitigating these risks requires thorough research, diversification, and staying updated on market trends. Additionally, passive income investing may present challenges such as initial capital requirements, lack of control over investments, and the need for continuous monitoring.

Overcoming these challenges involves developing a robust financial plan, seeking professional advice, and leveraging technology for efficient portfolio management. By acknowledging and addressing these risks and challenges, individuals can navigate the path to passive income with greater confidence and resilience.

Common Risks Associated with Passive Income

Passive income investments, such as stocks, are susceptible to market risks due to price fluctuations. Dividend non-payment or default is a potential risk in passive income investments. Additionally, the erosion of purchasing power caused by inflation should be a consideration. Passive income sources like real estate can be negatively impacted by property market downturns. Furthermore, changes in tax policies can affect the profitability of passive income streams.

Mitigating Risks in Passive Income Investments

Mitigating risks in passive income investments involves diversifying across various sources to reduce overall investment risk. Proper due diligence and research play a crucial role in identifying and mitigating risks within passive income opportunities. Regular monitoring of passive income investments is essential for identifying and addressing potential risks that may arise. Additionally, utilizing risk management strategies like stop-loss orders can provide protection for passive income investments. Factors such as asset allocation, investment horizon, and the quality of passive income sources are also vital considerations for effectively mitigating risks. By incorporating these risk mitigation practices, investors can work towards building a more resilient and stable passive income portfolio.

Turning Passive Income into Financial Freedom

Achieving financial freedom through passive income is a common goal for many investors. It’s essential to understand how passive income contributes to long-term financial goals and strategies for growing your passive income. Developing high-quality course content, building a successful blog, or becoming an Airbnb host are some of the best passive income ideas that require minimal effort but can generate substantial returns.

Investing in specific topics through affiliate programs and online marketplaces can also be a good way to turn passive income into financial freedom. As you continue to grow your passive income, it’s crucial to seek financial advice to make the best use of your earnings and ensure a stable financial future.

How Passive Income Contributes to Financial Goals

Passive income plays a vital role in achieving both short-term and long-term financial goals, serving as a supplemental source of income. Whether it’s saving for a vacation or planning for retirement, passive income streams contribute to these aspirations. Over time, these streams also aid in building wealth and financial security. By generating a consistent income, individuals can align their financial aspirations with the stability and growth that passive income provides.

Ultimately, passive income acts as a tool for achieving financial goals and realizing long-term financial ambitions, providing an additional layer of security and predictability to one’s financial future.

Strategies for Growing Your Passive Income

Reinvesting earnings from passive income can significantly boost the growth of investment portfolios. Continuous learning and skill improvement present the potential to unlock new streams of passive income. Regularly reviewing and adjusting passive income strategies is essential for maximizing income growth. Making use of compounding effects by reinvesting passive income enables the acceleration of wealth accumulation. Diversifying into various passive income sources plays a crucial role in facilitating incremental income growth and new opportunities.

Real-Life Success Stories of Passive Income from Index Funds

Throughout the years, numerous individuals have successfully generated passive income through index funds. These success stories serve as inspiration for those considering or already investing in index funds. One such individual, Mark, diligently invested a portion of his income into index funds over several years. As a result, he now enjoys a steady stream of passive income that provides financial stability and growth opportunities. Similarly, Sarah, a working professional, strategically diversified her investment portfolio with index funds, gradually building a reliable source of passive income.

Their experiences demonstrate the potential of index funds to generate substantial passive income over time, reaffirming the viability of this investment strategy for individuals seeking financial independence.

Case Study 1: Successful Passive Investing with Index Funds

A disciplined investment approach is highlighted in a successful passive income case study. The case study illustrates the potential of index funds to provide stable and consistent passive income, emphasizing their long-term wealth-building potential. It effectively showcases the advantages of index funds as a reliable source of passive income through a real-life example. This demonstrates the effectiveness of index funds in delivering passive income opportunities, making them a valuable addition to any investment portfolio.

Case Study 2: Achieving Financial Independence through Passive Income

Achieving financial independence through passive income sources is exemplified in this case study. The successful passive income obtained from index funds serves as a source of inspiration for those seeking financial freedom and stability. The journey portrayed in this case study highlights the transformative power of passive income, underlining its potential to lead individuals towards financial independence. By demonstrating the real-life impact, it emphasizes the significance of passive income from index funds in attaining long-term financial stability. This case study serves as a testament to the fact that passive income, particularly from index funds, can play a pivotal role in achieving financial goals and securing a stable financial future.

Can Index Funds Truly Provide a Stable Passive Income?

Index funds have the potential to offer a stable source of passive income over time. Their diversified portfolios, consistent dividends, and capital appreciation contribute to the stability of this income. Historical performance and a proven track record support the reliability of passive income from index funds.

Frequently Asked Questions

What is the best investment for passive income?

While there are various investment options for passive income, index funds are often considered one of the best choices. Dividend stocks and real estate investment trusts (REITs) can also generate passive income, but they come with more risk. Ultimately, the best investment for passive income depends on your financial goals and risk tolerance.

What is the definition of passive income?

Passive income refers to the income you earn effortlessly after making an initial investment of time or money. It includes rental property, dividend stocks, and index funds. This allows you to make money while focusing on other activities like traveling or spending time with family. The aim is to create a sustainable income source that supports your lifestyle without relying on active work.

How do taxes work on passive income?

Taxes on passive income vary based on income source and tax bracket. Dividends from stocks or mutual funds may be taxed at a lower rate. Accurately reporting earnings to the IRS is crucial. Consult a tax professional or financial advisor for guidance on managing passive income taxes.

Conclusion

Index funds offer a reliable and low-risk avenue for generating passive income. By understanding the concept of passive income and the benefits it brings, you can make informed decisions to secure your financial future. Index funds are a type of investment that allows you to diversify your portfolio and earn income without actively managing your investments. They offer the potential for long-term growth and stability while requiring minimal effort on your part.

However, it’s important to consider the risks and challenges associated with passive income investing and take steps to mitigate them. By building a diverse passive income portfolio and implementing effective strategies, you can gradually achieve financial freedom. Remember, with careful planning and perseverance, index funds can truly provide you with a stable and sustainable passive income stream.

AssetRise provides the ultimate rebalance calculator for your index funds that provide passive income.

Disclaimer: the information in this article is for information and research purposes only. It does constitute financial advice.