Bogleheads Long Term vs. Market Timing

Introduction

In the world of investing, there are many strategies of when to buy, sell, and hold.

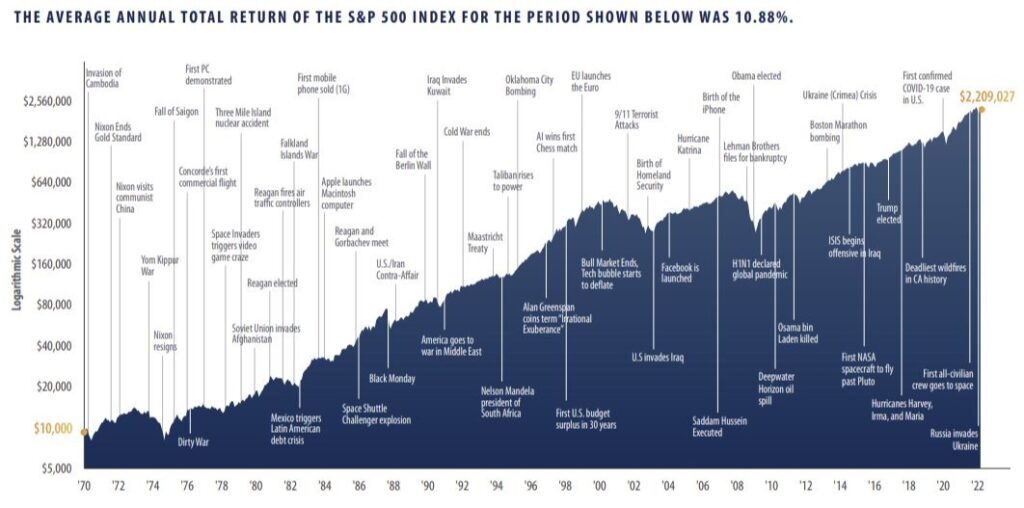

Boglehead investors apply a “buy and hold” strategy which consists of consistently buying a small group of index funds over a period of time, never selling. Bogleheads will use concepts of “Dollar Cost Averaging” to add money into the markets which provides a simple and consistent method to add money in both high and low markets.

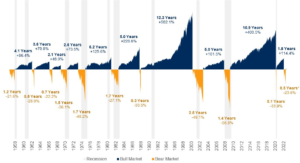

As you can see in the graphic, over the previous 40 years bull markets outlast bear markets. Bear markets are short, quick drops, that recover quickly. Which creates difficulty to attempt to time the perfect time to sell then rebuy.

Many investors who attempt to do so end up selling, sitting on cash, only to see the market return to new highs while they are not invested.

We suggest reading our Boglehead articles on Guide to Bogleheads Investing, Dollar Cost Investing, and What is a Boglehead to learn more.

where many investors will attempt to “sell high and buy low”. However

Conclusion

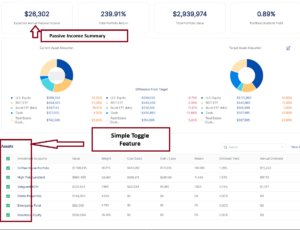

Following Bogleheads Index Investing via a simple asset allocation of Index Funds is a simple way to participate in the markets.

At AssetRise we believe in the Vanguard Bogleheads principles of Index Investing.

The AssetRise tool provides portfolio rebalancing, dividend projections, and portfolio return for all your investment accounts in a single dashboard. Add 2 accounts for free.

Add your first 2 portfolios for FREE. AssetRise provides the industry leading portfolio rebalance calculator.

Disclaimer: the information in this article is for information and research purposes only. It does constitute financial advice.