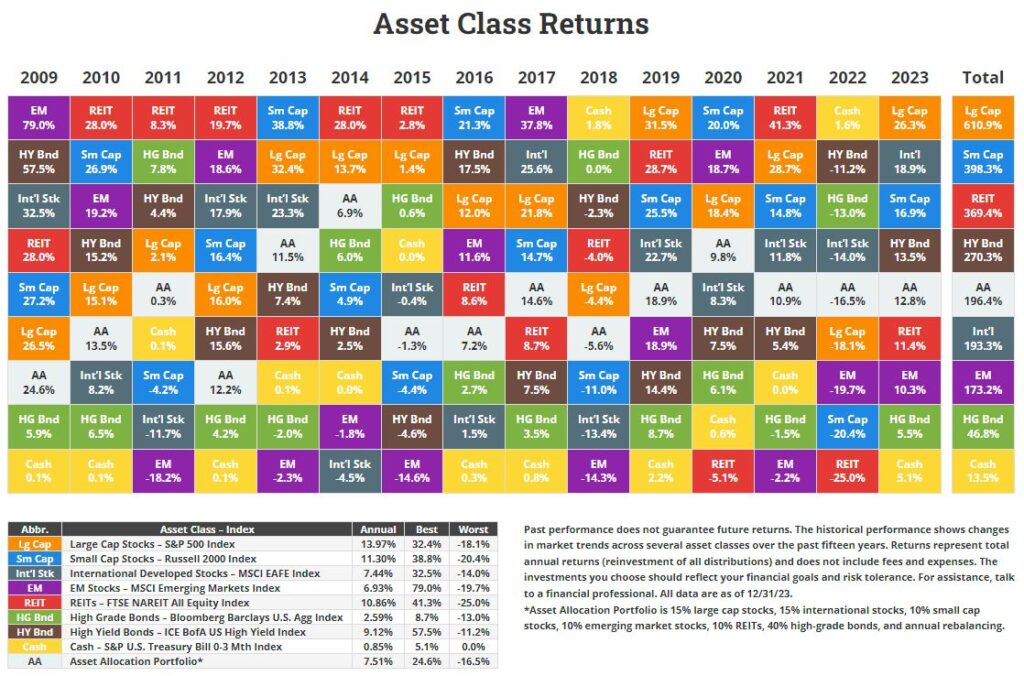

What is the Callan Periodic Table of Investments?

Callan releases this chart every January illustrating the annual return by asset class. The format is in the “periodic table”.

Why Is this Report Important to Boglehead Investors?

Bogleheads to not believe an individual investor can outperform the S&P 500 or other industry benchmarks over a sustained period of time. This chart maps out the returns of various asset classes, where the ability to predict next years returns are impossible.

Why Do They Release This?

Its to illustrate that you cannot predict the future of markets. Even if it seems obvious that after a down year, the next year will be strong, its never 100% accurate.

What is Stock Market Timing?

Stock market timing is attempting to pick stocks that perform better than a benchark such as the S&P 500.

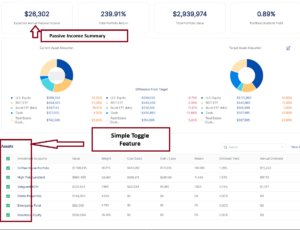

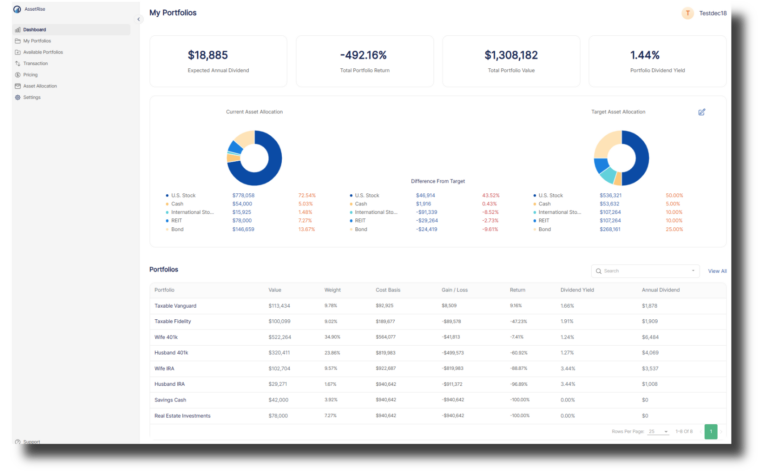

AssetRise (below) assists investors to keep their portfolio in balance to minimize losses and maximize gains.

In Closing

Investors cannot beat the market over a period of time. This is the premise of following the Boglehead investing practices of a simple, diversified Vanguard ETF portfolio, using low cost and rebalancing to maximize returns.

Learn more about Boglehead investing.

AssetRise was developed to track and manage a Boglehead Vanguard index fund portfolio across many accounts. This allows the investor to keep a simple asset allocation at all times.

Get started with AssetRise for free.