Why I chose to be a Boglehead Investor

I found Bogleheads out of necesitty. After trying a few Advisors at Merril Lynch and UBS, I realized they did not have my best interests at heart. So I had no choice but to manage my finances myself.

I knew that stock picking was not the way, as I tried that prior to the financial advisors. After much research I came across the Bogleheads.org forum online, and knew it fit my investment management needs.

After finding the Bogleheads Guide to Investing, that became my investment blueprint to build wealth.

So after 15 years of Boglehead Investing, why did I pick Boglehead Investing and what have I learned?

First, what are my requirements for an investment strategy?

First I needed a strategy for when the market was performing well, going down, and even sideways. Second I could not spend too much time researching investments as I have a full time job and family. Last, it needed to be simple and proven over a long period of time.

What other options did I try?

- Financial Advisors at UBS and Morgan Stanley

- Jim Cramer stock picking on CNBC

- Zacks Stock Picking

- The Motley Fool Stock Picking

- Buying high risk penny stocks hoping to hit it big

So let me tell you what I learned, compare and contrast vs. Boglehead Investing.

Financial Advisors

Are all financial advisors bad? Of course not. There are many great advisors out there, especially for wealthy clients who need advice on tax benefits or need a wholistic plan of their estate. However for the rest of us, advisors will follow a company template blindly which may not be the best for you. I was in over 100 individual stocks and high cost mutual funds which were underperforming the S&P 500.

Also, their interests are misalinged to their clients as the advisor makes money off your portfolio no matter the return on investment. So if you are performing poorly, they still get a hefty commission.

Jim Cramer and CNBC

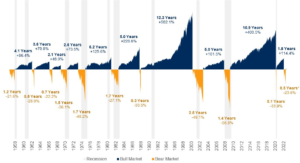

Jim is very entertaining. If you are looking for a hedge fund manager then maybe he’s the guy for you. CNBC makes money when there is panic, so they need to create a sense of urgency to spike ratings. Also, their guests talk about the buying in and out of the market, which is a form of Market Timing which Bogleheads to do not.

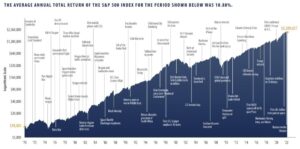

As an individual investor you need a portfolio plan not just picking stocks. Also, do you really have hours a day to research stocks? How about market timing? Do you really believe you can beat a simple stock index when Active Mutual Fund managers cannot beat the S&P 500? Here’s the Bogleheads view on Market Timing and a blog on our site breaking down ETF’s vs. Mutual Funds including Active Management vs. Passive Management.

The Motley Fool and Zacks, Penny Stocks

I could have lumped these into the Jim Cramer category as stock picking. Each of these services recommend a stock to buy every few weeks. When the markets are strong, such as a tech stock bubble they may hit on a few (Tesla, Amazon) but will miss on most. Also, how do you know when to get into a stock and when to sell?

Similar to “penny stocks”, nothing wrong with setting aside a few bucks to maybe hit on a few. But is that really a long term wealth building strategy? Will you be your retirement that you can hit the next Tesla for a 1,000% return? Look up Lucent Technology, WorldCom, General Motors – many large popular companies widely held by individual investors that went to $0 so you lost everything.

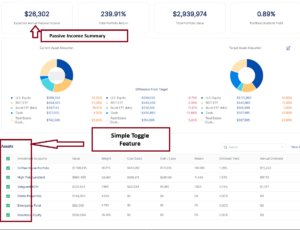

What I’ve seen many investors do is set aside a small amount of their portfolio into stock picking (betting) but keep the majority in a Boglehead “Lazy Portfolio” including index funds managed with a tool like AssetRise for rebalancing.

So what did I do?

I researched the WIKI on Bogleheads.org, read every book I could find on Portfolio Asset Allocation, Market Timing, ETF vs. Mutual Fund, and Bogleheads Investment Strategy. Here is a blog post of the books I read to build my investment knowledge.

Then I got the nerve up to manage my investments myself. I transferred from Morgan Stanely into my personal investment account. I sold off the hundreds of stock and high priced mutual funds into cash. Then slowly allocated cash into my Boglehead Lazy Portfolio over the period of 90 days.

I did a great deal of research on “lump sum investing vs. dollar cost averaging”. I chose to do a mix of both, you can follow in my blogs on that topic.

What I learned was I was always investing “new money” into my account via taxable and retirement accounts, so I was doing DCA constantly.

Also, I injected new money to rebalance my asset allocation. So for example, if I was low in stocks then I focused my DCA into stocks. I never sold anything in my taxable account, nor had the need since I would DCA new money into that allocation.

You can read further on asset allocation here.

I also learned one of the keys is to now track and manage my portfolio. A critical component is portfolio management, and keeping my asset allocation on target.

How do I track my Portfolio?

I quickly found that my investment accounts at Fidelity and Vangaurd did not provide sufficient tools to manage my portfolio. So like most Bogleheads, I ended up creating a custom spreadsheet. However the problems with spreadsheets is you need to keep tickers current, you need to see your allocation across multiple accounts, and then you need to have expertise in Excel or Google Sheets.

For this reason many Boglehead investors use AssetRise for Lazy Portfolio management and rebalancing. Our tool aligns to Boglehead investing, is unbiased, and is aligned to the individual investors goals.

Pro and Con of Boglehead Investing

Like every strategy there are advantages and disadvantages, so what is my summary of the Bogleheads investment strategy?

Boglehead Pro:

- Simple: Simple, proven strategy that is easy to follow

- DIY Friendly: Designed for an individual investor to follow

- Time: Small time committment, maybe a couple hours a month

- Proven: Years of research to draw on

- Low Fees: Investment fees stay with you vs. an advisor which can result in 1 to 3% annual back into your pocket

- Community: Amazing community at Bogleheads.org

- Retirement: Long term plan to build wealth

Bogleheads Cons:

- Capped Returns: You will not hit it big buying an index in a short period of time such as buying Tesla or Apple at the bottom then timing the exit for 1000%+ gains.

- Self Managed: You do need to invest time into watching and monitoring your portfolio. Including taxes and annual rebalancing.

If I was starting today, what would I do differently?

If I were to do it over I would pick Bogleheads investing. As my core savings and portfolio, its a high probability you WILL build wealth over time.

I was self taught, so had to learn by trial and error. I certainly missed out on some high flying stocks, by sticking with Bogleheads. But the good news is my plan is wokring: I’m hitting my long term retirement goals using the Bogleheads philosophy.

Conclusion:

In conclusion you see why I chose to be a Bogleheads investor. Its paid off over time, as I’m exceeding my retiement savings goals.

I’m pleased with my decision to use Bogleheads as my investment strategy and retirement savings plan.